(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 49.7%

T2107 Status: 30.8%

VIX Status: 16.9

General (Short-term) Trading Call: neutral (just switched from bearish)

Active T2108 periods: Day #33 over 20%, Day #32 over 30%, Day #3 over 40% (overperiod), Day #5 below 50%, Day #7 under 60%, Day #347 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Commentary

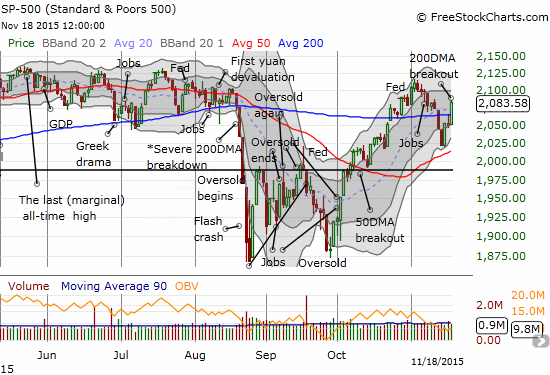

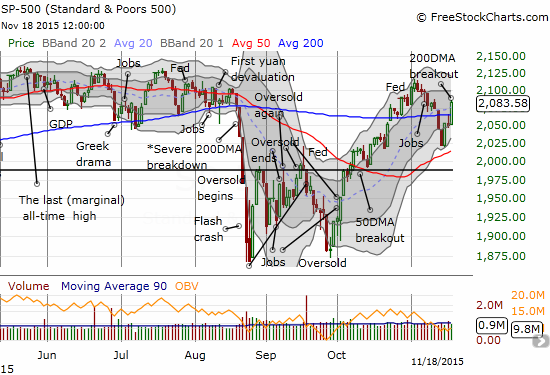

And just like that, the S&P 500 (SPY) has flipped the script. Today’s 1.6% gain on the S&P 500 bullishly pushed the index through resistance at the 200-day moving average (DMA).

The S&P 500 punches through resistance at its 200DMA

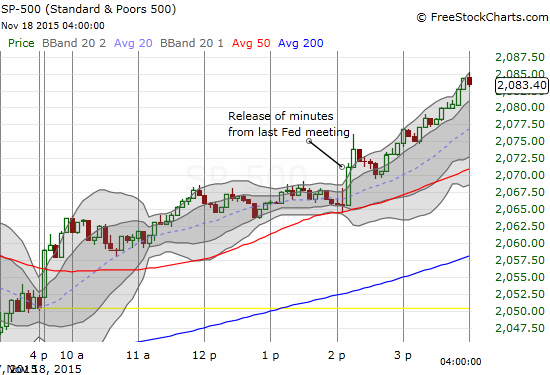

The proximate reason for the rally was the release of the minutes from the last Fed meeting. However, this 5-minute chart makes it clear that buyers had a rally in mind ahead of the minutes.

The S&P 500 rallied at the open, drifted higher into the Fed minutes, popped after the minutes, and surged nearly straight up into the close.

Some media outlets guessed that the market got giddy because the minutes suggested that a December rate hike is now near certain. I bolded a guilty quote below. Also note the surrounding text: the Fed clearly kept up the aura of flexibility with all the standard conditionals, including a reminder that ALL policy options remain open.

Leave A Comment