(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 68.6%

T2107 Status: 63.0%

VIX Status: 11.8

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #200 over 20%, Day #20 over 30%, Day #19 over 40%, Day #17 over 50%, Day #11 over 60% (overperiod), Day #90 under 70%

Commentary

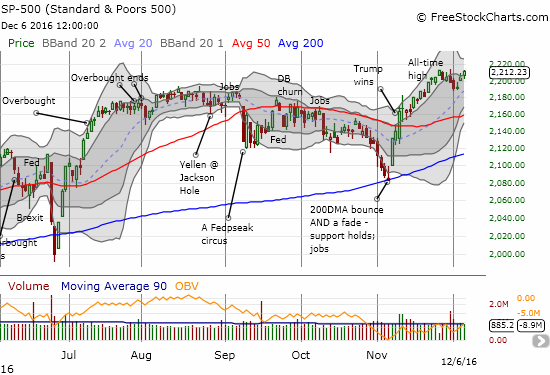

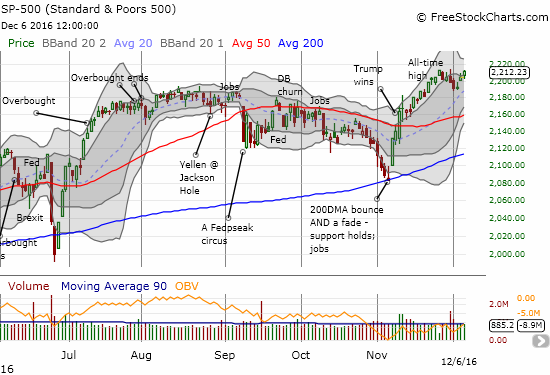

After a bit of a hiccup since the last T2108 Update, the stock market is back on track. The breather for the S&P 500 (SPY) seems to be over with T2108 at 68.6% and just below the 70% overbought threshold. The S&P 500 closed just one point off its all-time high set on November 25th.

The S&P 500’s breather did not last long – a major breakout lies around the corner.

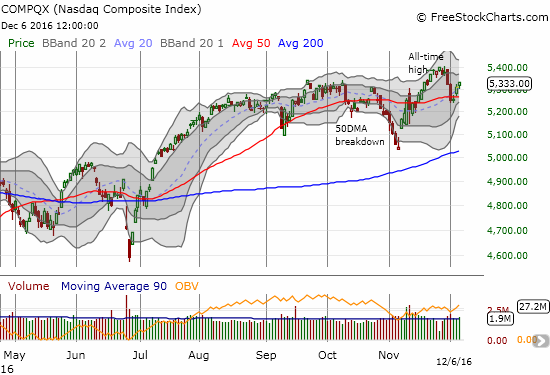

The Nasdaq (QQQ) started December completing a sharp 2-day sell-off. The recovery is moving one slow step at a time.

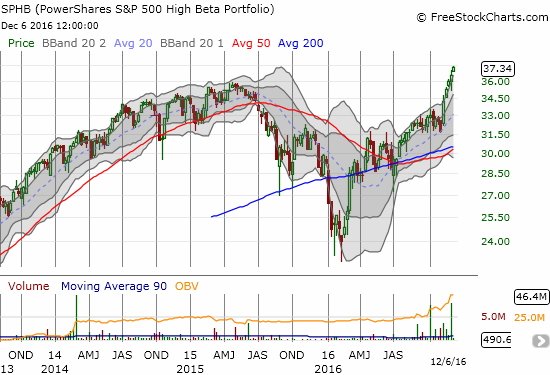

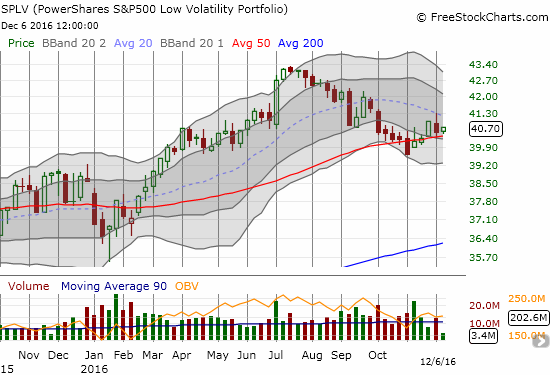

The S&P 500 looks ready to break out mainly thanks to the high beta components of the index. PowerShares S&P 500 High Beta ETF (SPHB) is already making new all-time highs after last month’s breather. The PowerShares S&P 500 Low Volatility ETF (SPLV) remains the laggard slowing down the action. I use a weekly chart for SPHB to show perspective. The flash crash from 2015 prevents me from showing an extended weekly for SPLV.

PowerShares S&P 500 High Beta ETF (SPHB) looks like a champ again.

PowerShares S&P 500 Low Volatility ETF continues to struggle to break free from a downtrend in place since July.

Needless to say, my short-term trading call remains bullish. The volatility index, the VIX, is a potential caveat. The VIX is hovering above its lows for the year. The post-election run-off for volatility appears set to continue, but complacency is already reaching “maximum” levels.

Leave A Comment