(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 18.5%

T2107 Status: 24.1%

VIX Status: 26.1

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #6 below 20% (oversold), Day #7 under 30%, Day #30 under 40%, Day #70 under 50%, Day #87 under 60%, Day #285 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

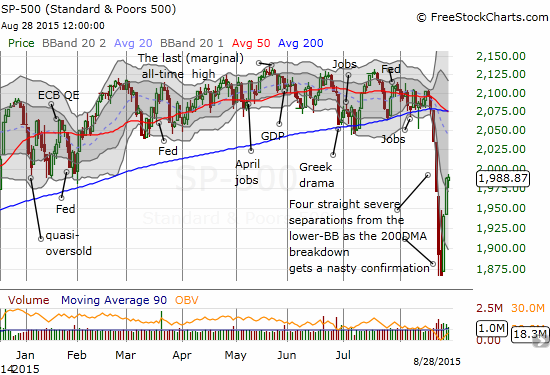

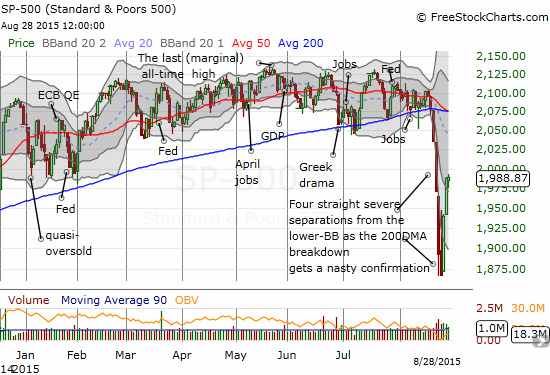

Did the S&P 500 (SPY) really close the week with a 0.9% gain? If you were not paying any attention to the market, you might mistakenly think all is well and normal, just another sleepy week of summer.

The S&P 500 makes a major swing: it lost as much as 5.2% for the week and ended the week with a 0.9% gain.

T2108 also made a complete recovery with a close at 18.5%, right in line with last week’s 18.1% close. T2108 even made a run at ending the oversold period when it got as high as 19.4%.

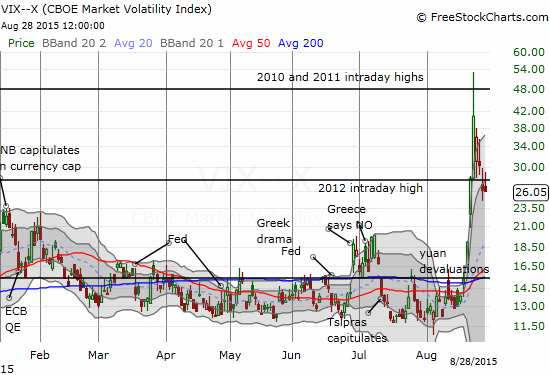

The volatility index, the VIX, stayed essentially flat from Thursday’s close and closed below the previous week’s close. The VIX remains in a position for less aggressive traders to make T2108 oversold buys with the caveats I mentioned in the last T2108 Update.

The volatility index is in retreat but remains elevated.

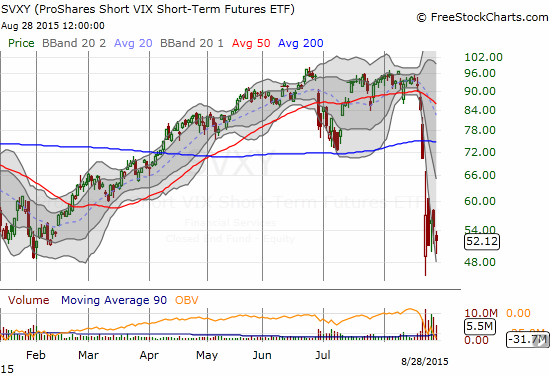

Strangely, the ProShares Short VIX Short-Term Futures (SVXY) lost a sizable 4.9% despite the flat close of the VIX. Once again, the 51 level provided modest support for SVXY. This time I decided to dive in with another short-term trade (meaning this supplements the SVXY shares I have accumulated as a part of the T2108 oversold aggressive trading strategy).

Despite the S&P 500’s roaring comeback off its 10-month low, ProShares Short VIX Short-Term Futures is still struggling with its 2015 low. A buying opportunity or a warning?

Leave A Comment