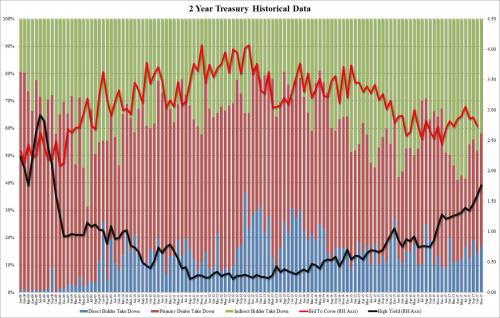

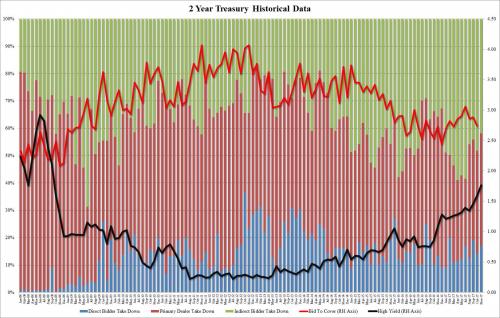

With 2Y yields having jumped sharply in recent week, it was not surprising that today’s auction of $26 billion in 2Y paper would have a high yield, and sure enough, printing at a high yield 1.765%, the highest since September 2007, tailing the When Issued 1.763% by 0.2bps, and well above the six previous auction average of 1.410%. This was the third consecutive tailing 2Y auction.

The internals were hardly impressive, with the bid-to-cover of 2.725, lower than both last month’s 2.74 and also below the six previous auction average 2.91. In fact, it was the lowest since January’s 2.682%, with total bids of $72.3bn for $27.4bn in notes sold vs six previous auction average of $78.0b in bids for $28.3b in notes sold.

Also not surprising perhaps is that foreign buyers were less than enthusiastic, with Indirect bidders awarded only 41.9% of the auction, down sharply from last month’s 48.2%, and below the 6 month moving average of 51.7%. It was also the lowest since December 2016. Dealers were awarded almost the same, or 41.2%, far higher than the six previous auction average 32.7%. Finally, direct bidders received 17% of the auction, roughly in line with the 17% average of the prior 6 auctions.

Overall, the auction confirms that investor interest for the short-end of the curve is waning, and suggests that more rate hikes by the Fed are coming, which in turn will push the 2Y yield even higher, further steepening the yield curve in the coming days.

Leave A Comment