Photo Credit: Mike Mozart

Target Corp. (TGT) Consumer Discretionary – Multiline Retail | Reports May 18, Before Market Opens

Key Takeaways

Discount retailer, Target, is scheduled to report first quarter earnings this Wednesday, before the market opens. Target’s widespread acceptance amongst millennials has kept the company competitive against the likes of Amazon (AMZN) and Wal-Mart (WMT). Even so, TGT has had trouble growing revenues in the past 2 fiscal years, with last quarter posting a sales decline of 0.6%, and this quarter looking even worse.

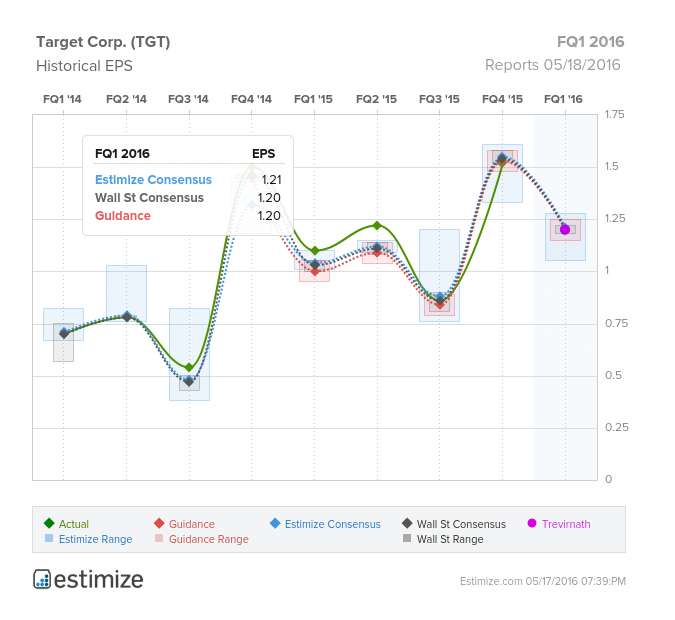

The Estimize consensus is looking for earnings per share of $1.21 on $16.36 billion in revenue, 1 cent higher than Wall Street on the bottom line. Compared to a year earlier profits are projected to increase 9% while sales are predicted to fall 4%. Despite negative revenue growth, the stock is up 7.5% in the past 3 months and historically increases 3% in the 30 days following its earnings report.

Like most retailers, Target has been focused on expanding its omnichannel capabilities to compete with the slew of online retailers. In the fourth quarter, digital channel sales increased by 34%, contributing 1.3% to comp sales growth. Overall, comparable sales increased 1.9% driven by a fifth consecutive quarter of increased traffic. Target’s focus on well performing categories coupled with its expanding food category has transformed the company into a one stop shop for everyday needs. Moreover, the sale of its pharmacy business to CVS will alleviate some pressure on gross margins.

Leave A Comment