Begun The Trade War Has… and that means the end of the world, apparently?

Video length:00:01:13

Or not…While President Trump is being blamed for this week’s ugliness in stock markets, some more open-minded observers could see a few other factors involved…

If The Dow closed down 1% today it would be four 1%-down-days in a row – the first time since August 2015 (the China deval and flash crash).

Video length: 00:00:06

BUT… it turns out that Trade Wars are good!

On the day, Small Caps outperformed, but it seems investors are not in the least bit worried that the world is ending due to Trump tariffs… (/sarc)

As Gluskin-Sheff’s David Rosenberg notes, the recovery in the stock market is being led by health care, consumer staples and telecom — the recession sectors! How interesting. Cyclically-sensitive Transports, meanwhile, are getting trampled.

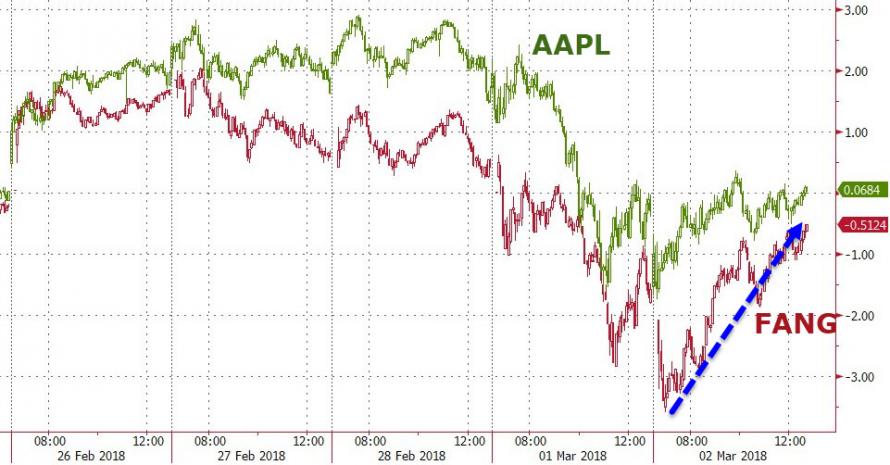

Total buying panic into safe-havens AAPL and FANGs… buybacks anyone?

Today’s jump in stocks off the opening lows was a massive short-squeeze… “Most Shorted” stocks are up 4.7% from the lows today!

The Dow bounced back to its Fib38.2% retracement of the big drop…

And remember the massacre in gunmaker stocks overnight? Everything’s fine now…

Still all-in-all, not a pretty week…

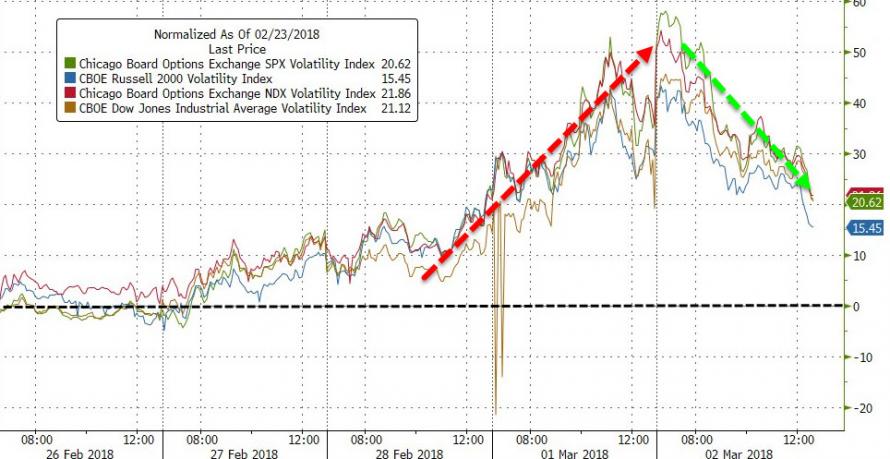

Vols across all major equity indices were higher on the week…

Treasury yields jumped today amid chatter of rate-locks on looming issuance, but on the week 30Y Yields were 2bps lower and 5Y 1bp higher…

The Dollar Index ended the week higher for the 4th of the last 5 weeks…

Critically however, the last two days have seen the dollar slump back from the Mnuchin Massacre ledge once again…

Leave A Comment