A couple of weeks ago, I discussed the recent breakout to “all-time” highs and the potential run to 3000 for the S&P 500 index.

“Regardless of the reasons, the breakout Friday, with the follow through on Monday, is indeed bullish. As we stated repeatedly going back to April, each time the market broke through levels of overhead resistance we increased equity exposure in our portfolios. The breakout above the January highs now puts 3000 squarely into focus for traders.

This idea of a push to 3000 is also confirmed by the recent ‘buy signal’ triggered in June where we begin increasing equity exposure and removing all hedges from portfolios. The yellow shaded area is from the beginning of the daily ‘buy signal’ to the next ‘sell signal.’”

Importantly, at that time I specifically noted:

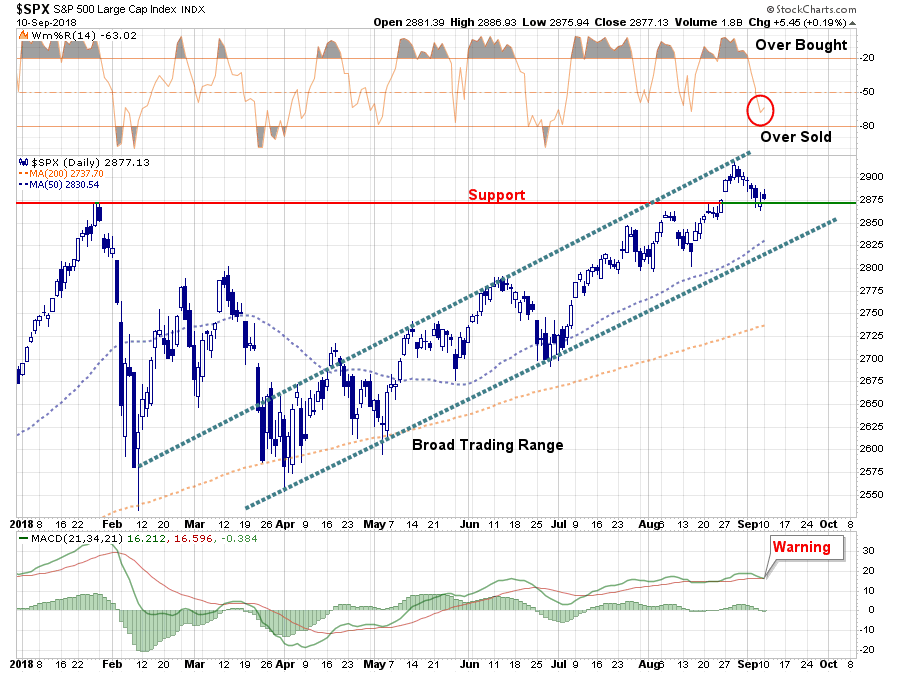

“However, with the markets VERY overbought on a short-term basis, we are looking for a pullback to the previous ‘breakout’ levels, or a consolidation of the recent gains, to increase equity exposure further.”

That pullback occurred last week providing a very short-term trading opportunity with a higher reward/risk ratio than what existed previously.

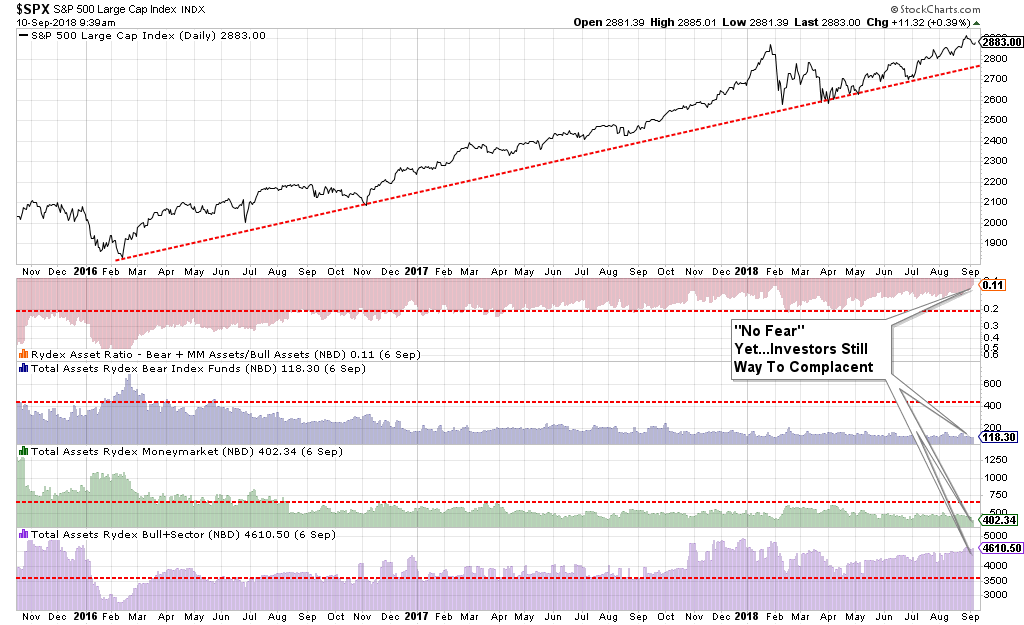

The only short-term concern is the warning signal in the lower panel. Just like in early August, when a warning was issued, it never matured into a deeper correction. While I am not dismissing the current warning, given Monday’s bounce off of support combined with a very short-term oversold condition, and very high levels of bullish “optimism,”the most likely outcome currently remains a push towards 3000 through the rest of this year. This high level of “optimism” is shown in the chart below which compares the S&P 500 to investors in bearish funds, money markets, and bullish funds. (Investors are “all in.”)

Remember, in the very “short-term,” it is all about “psychology.”

Leave A Comment