In this past weekend’s revised newsletter format, I noted the markets were due for an oversold rally. To wit:

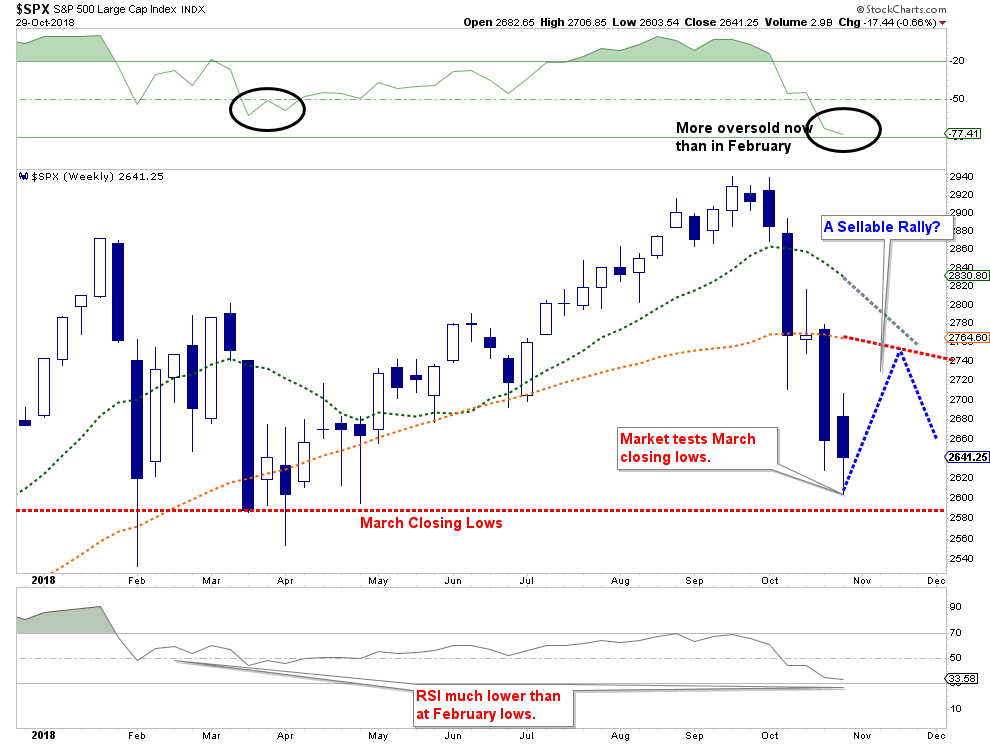

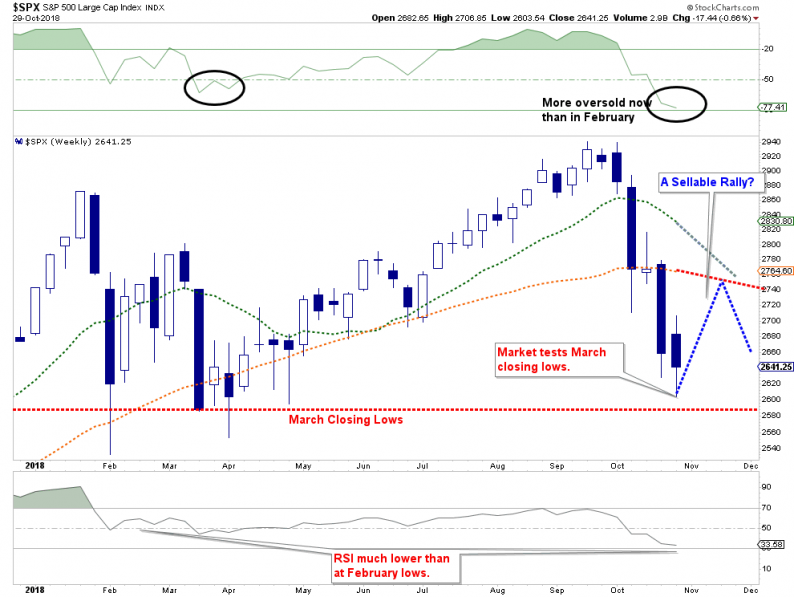

“While technically there is a weekly confirmed sell-signal in place, the very oversold condition continues to suggest a short-term rally back to the top of the current trading range is likely.”

Yesterday, the markets surged out of the gate as buyers came in and it looked as if a tradeable rally was set to ensue. But such was not to be the case as by late afternoon the markets turned red.

The good news, if you want to call it that, was that the market did approach, and bounce off of, the March weekly closing lows. With the market now more deeply oversold than what was seen earlier this year, we still expect there to be a counter-trend rally in the next several days.

The bad news is that the target for that rally continues to decline. The target range has declined from 2800-2850 previously to just 2720-2750 currently.

There are several reasons a rally is highly likely.

Psychology:

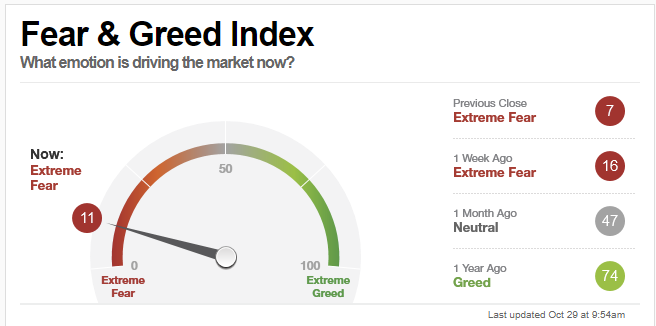

Sentiment has gotten much more negative as of late with fear/greed levels falling sharply as shown by the CNN Fear/Greed Index.

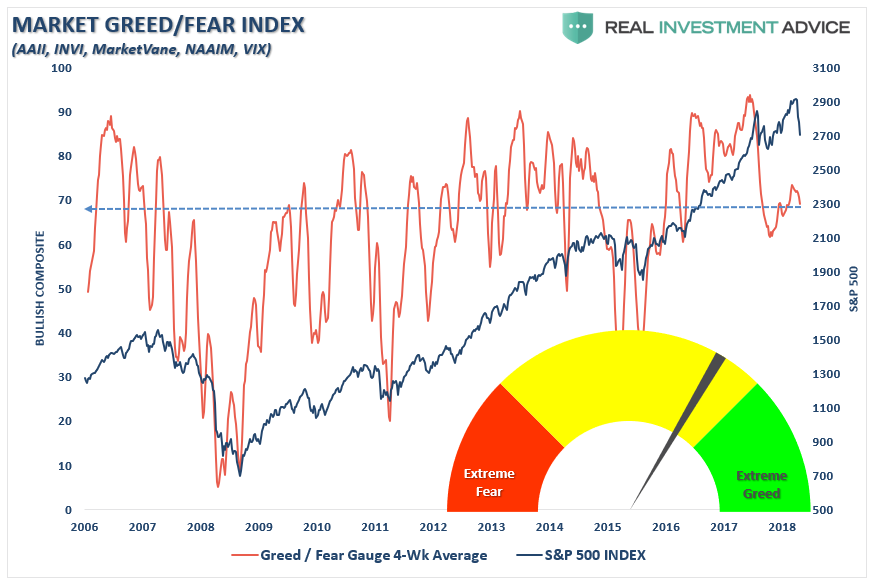

However, while “sentiment” has become much more fearful in the short-term, suggestive of a potential short-term bottom, investment positioning doesn’t show as equally of a fearful position. In other words, while investors are “fearful of a crash,” investors aren’t really changing their allocations much.

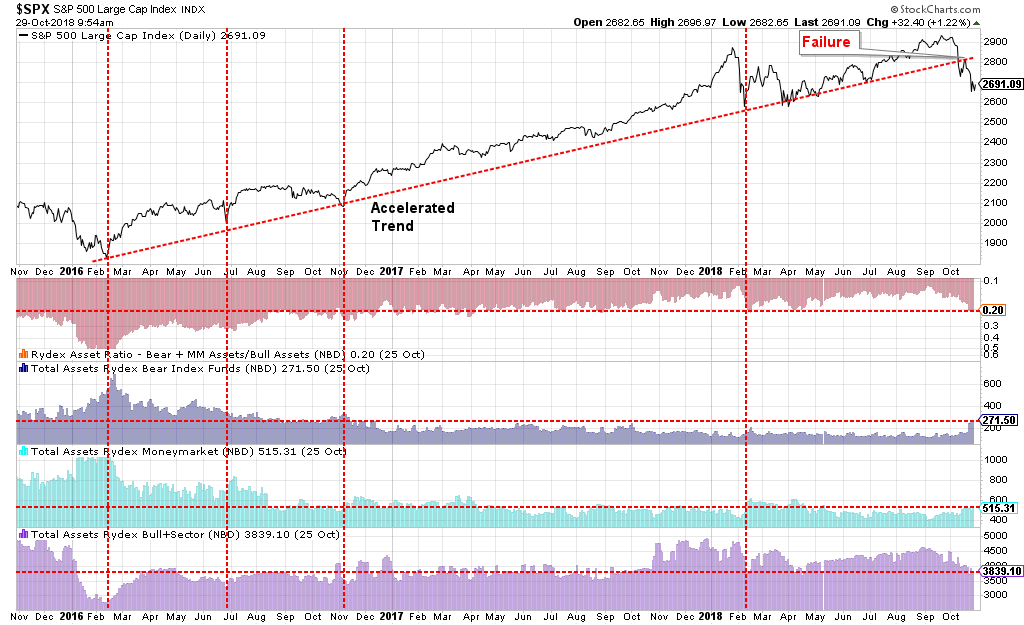

The same goes for positioning by looking at the Rydex bullish funds to bearish funds ratios. While they have definitely reverted back to levels seen at the February lows, they are nowhere near the levels seen during the 2016 bottoms.

The current psychological conditions suggest a short-term bottom in the markets are likely. However, given the level of “fear” relative to current positioning is not at levels seen during more lasting bottoms, it keeps us cautious on assuming the current sell-off has been completed.

Fundamental:

While economic data remains robust over the last couple of quarters due to massive government spending for hurricanes, wildfires, and defense, much of that support has now worked its way through the economy. Higher interest rates are beginning to weigh on the economically important sectors of housing and autos.

Leave A Comment