During my morning reading, I ran across an interesting article from Paul Lim via Time giving several reasons why the stock market will “rise for a ninth straight year.”

“For ordinary Americans, 2017 is likely to feel like the best year economically since the Great Recession.

The recovery is finally expected to trickle down to you in the form of an improved job market, higher wages, and growing spending power.

And, despite the advanced age of this bull, your improving fortunes just may keep U.S. stocks chugging along too, as consumers represent 70% of the U.S. economy.“

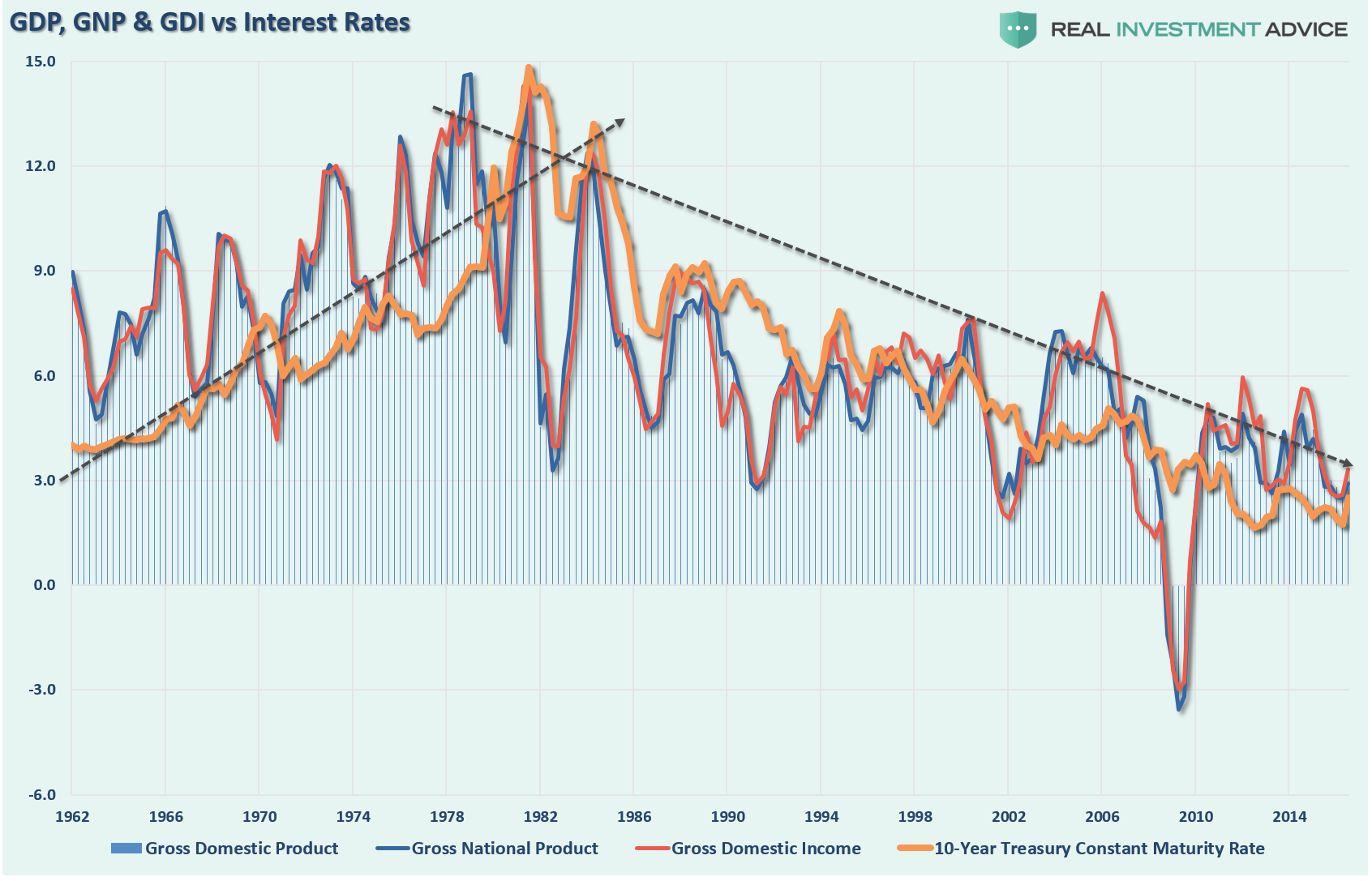

While his points are valid, but very debatable, it is critical to remember the stock market and the economy are two different things. GDP growth and stock returns are not highly correlated. In fact, some analysis suggests that they are negatively correlated and perhaps fairly strongly so (-0.40).

However, it isn’t just Paul pushing the bullish commentary, but virtually the entirety of the media press. The siren’s song of “stay long my friends” has risen as of late as the market has soared following the election. But here is the interesting takeaway:

The reasoning for the continuance of the “bull rally” over the last several years has been footed by the common threads of:

Now, the bull market will continue because:

It can’t be both.

Interest rates have remained low because of the Federal Reserve’s actions and weak economic growth rates, corporate profitability is high due to accounting gimmicks, and the Fed’s liquidity programs have artificially inflated stock prices. As far as the economy goes, I think it looks like it looks.

Yes, there are lots of wiggles along the way. Each bounce was expected to be “the turn” into a lasting uptrend with respect to policy changes, etc. They weren’t. Debt has continued to erode the underlying ability for economic growth to accelerate and with interest rates rising, the negative feedback loop will likely manifest itself sooner than most expect.

However, in the meantime, the promise of a continued bull market is very enticing. But it is important for investors to remember we have only one job: “Buy Low/Sell High.” It is a simple rule that is often forgotten as “greed” replaces “logic.” It is also that simple emotion of greed that tends to lead to devastating losses. Therefore, if your portfolio, and ultimately your retirement, is dependent upon the thesis of a continued bull market, you should at least consider the following charts which cover both fundamental and technical views.

Leave A Comment