Yesterday, the markets opened higher but drifted lower into the afternoon as the support behind the markets as of late have continued to remain weak.

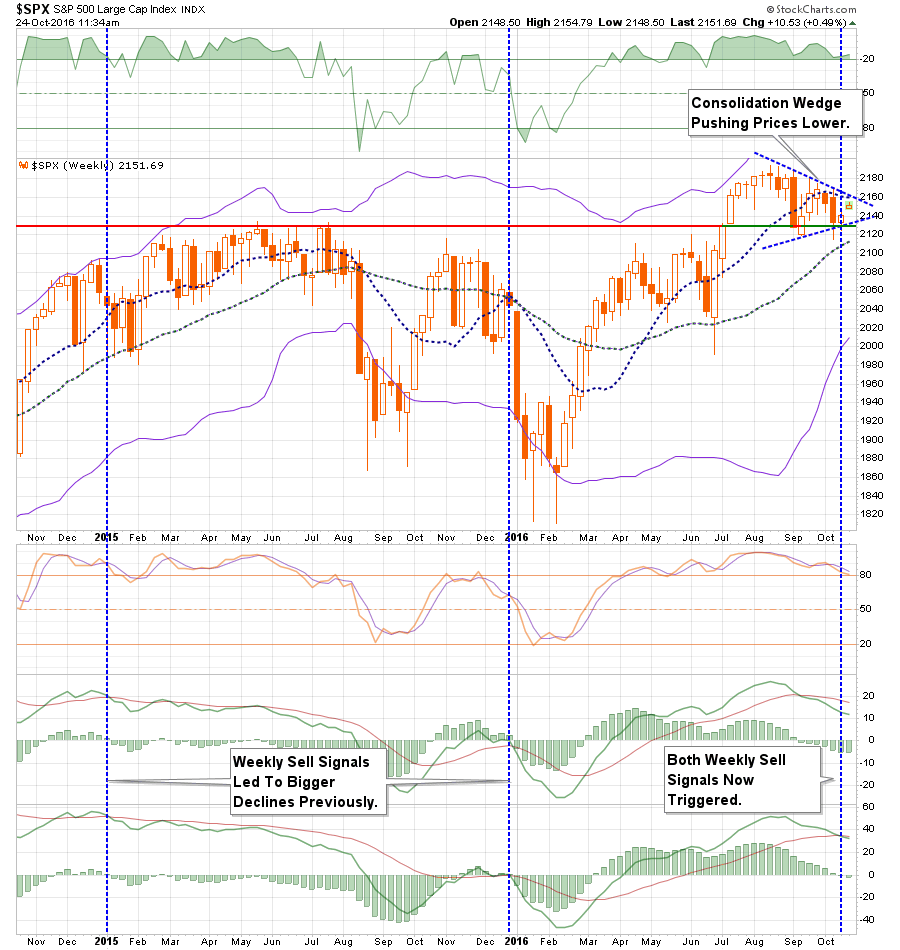

As shown in the chart below, the markets remain trapped between the downward price trend from the summer highs and the rising bottoms from the September sell-off. Importantly, the market has maintained support at the all-important breakout level of 2125, for now. This keeps the bull market intact momentarily, but the resolution of the current consolidation will be important as to where the market goes next.

Importantly, the market has registered a confirmed weekly sell signal as shown in the bottom part of the chart.Considering this signal is being registered at fairly high levels, this suggests there is a potential for a rather deep correction at some point. However, as shown above, this process can take some months to play out.

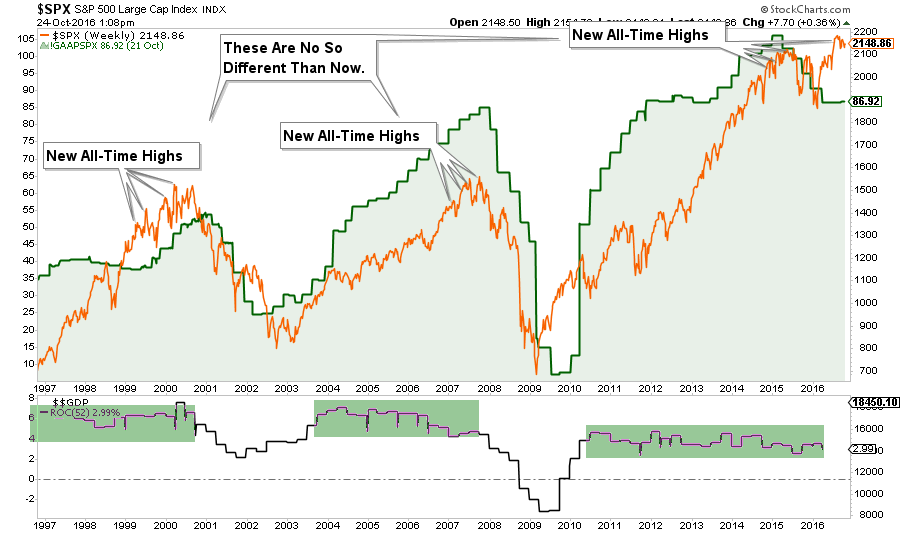

However, in the longer-term, it is only fundamentals that matter. What is happening between the economic and earnings data is all you really need to know if you are truly a long-term investor.

Unfortunately, you aren’t.

I say that because I would be willing to bet before you even read this article you have already checked on your investments at least once today, looked at the market, and have fretted over some investment you have. True long-term investors don’t do that.

The emotional biases of being either bullish or bearish, primarily driven by the media, keep you from truly focusing on long-term outcomes. You either worry about the next downturn or are concerned you are missing the rally. Therefore, you wind up making short-term decisions which negate your long-term views.

Understanding this is the case, let’s take a look at the technical case for the markets from both a bullish and bearish perspective. From there you can decide what you do next.

THE BULL CASE

1) The Fed Won’t Let The Markets Crash

This is the primary support of the bullish case, and frankly, one that is difficult to argue with. Despite all of the hand-wringing over valuations, economics or fundamental underpinnings, stocks have been, and continue to be, elevated due either to “direct” or “verbal” accommodation.

Leave A Comment