With the markets closed yesterday, there is little to update from this past weekend’s newsletter. However, in case you missed it, here was the crux of the analysis:

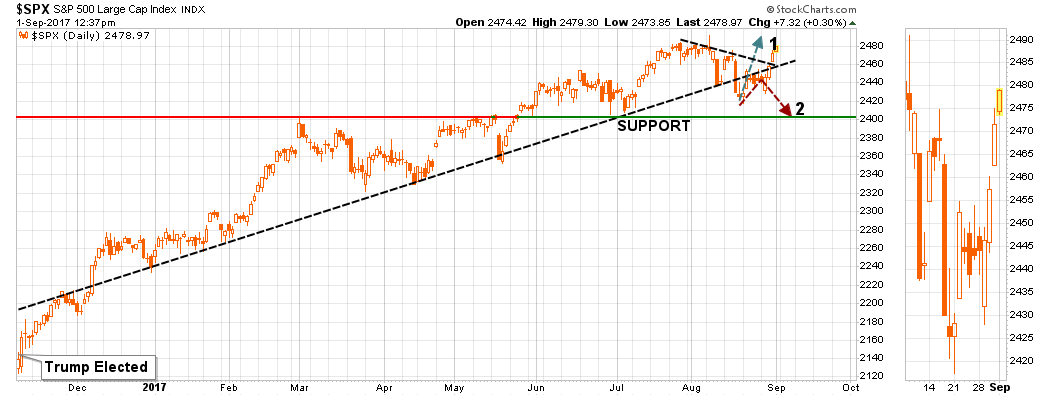

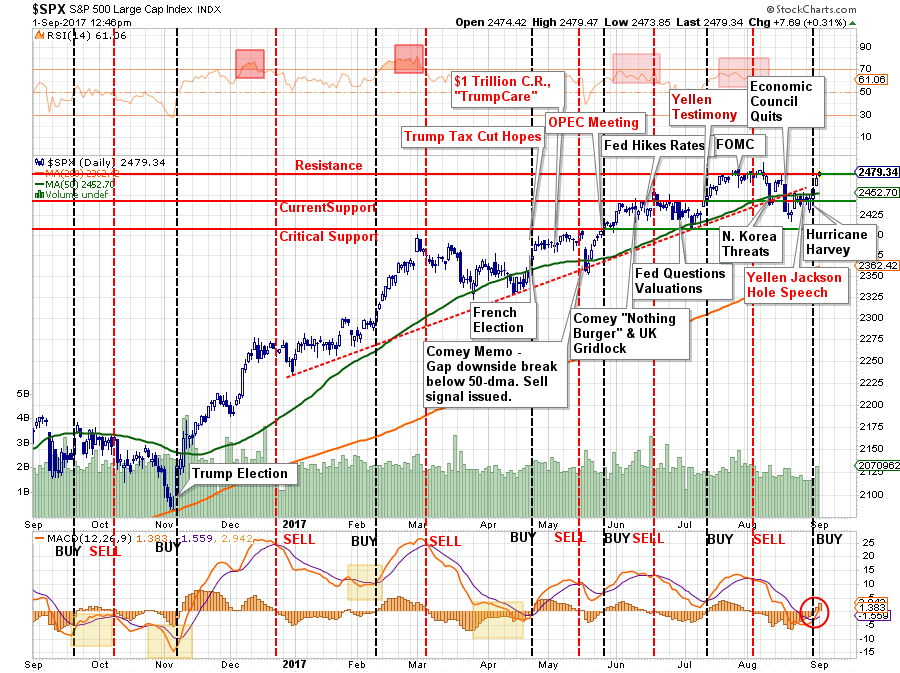

“While it looked like “scenario 2” was going to play out early last week, that was reversed as the markets started to bet on the optics of a stimulus fueled boost to the economy.“

“Regardless, the market broke back above its 50-dma and cleared the recent downtrend to re-confirm the bullish bias. Furthermore, the reversal of the short-term ‘sell signal’ also provides a tailwind for investors currently which suggests that markets should be able to reach all-time highs before the next corrective action begins.”

“Importantly, the bullish trend remains intact thereby keeping portfolios allocated toward equity risk. This “return to normalcy” is occurring within the context of a very short-term view. With valuations extended, economic data weak and exuberance elevated, this is not a time to ignore the rising longer-term risks to overly aggressive portfolio allocations.”

It is that last point I want to address today.

Seen This Before

I have been managing money in some shape, form or fashion for the last 30-years. During that time I have witnessed the rise and fall of one investing cycle after another with each being touted as “different” for one reason or another. However, they have all ultimately had three-things in common:

The rush into “robo-advisors,” stock trading apps and a surge in online trading accounts define point one. As Charles Schwab stated recently:

“Clients opened more than 100,000 new brokerage accounts per month during the quarter, putting total new accounts at 362,000, the highest quarterly total in 17 years excluding acquisitions. New retail brokerage accounts grew 44% to 235,000 during the March-ended quarter for a total of 7.2 million accounts.”

Hmmm…17-years ago was this statement from C.S. First Boston in 1999:

“Trading volumes surged as much as 50 percent in January, after a 34 percent rise to a record 340,000 trades a day in the fourth quarter.”

Leave A Comment