In this past weekend’s newsletter, I laid out a case for being “cautiously optimistic” as technical action had improved and short-term buy signals had been triggered. To wit:

“By the time “buy” and “sell” signals are triggered, the initial recovery has already completed most of its initial move. This is completely expected. Importantly, if the markets are indeed reversing course, the entry back into the markets will still be very early into the next overall advance.

The importance of waiting for confirmation of a change in market dynamics, even for shorter term traders, is to establish a higher reward-to-risk ratio when putting investment capital to work. This methodology, while you will not “buy the bottom” or “sell the top,” reduces the probability of speculating incorrectly and then becoming emotionally trapped into a position that becomes detrimental to portfolio performance.

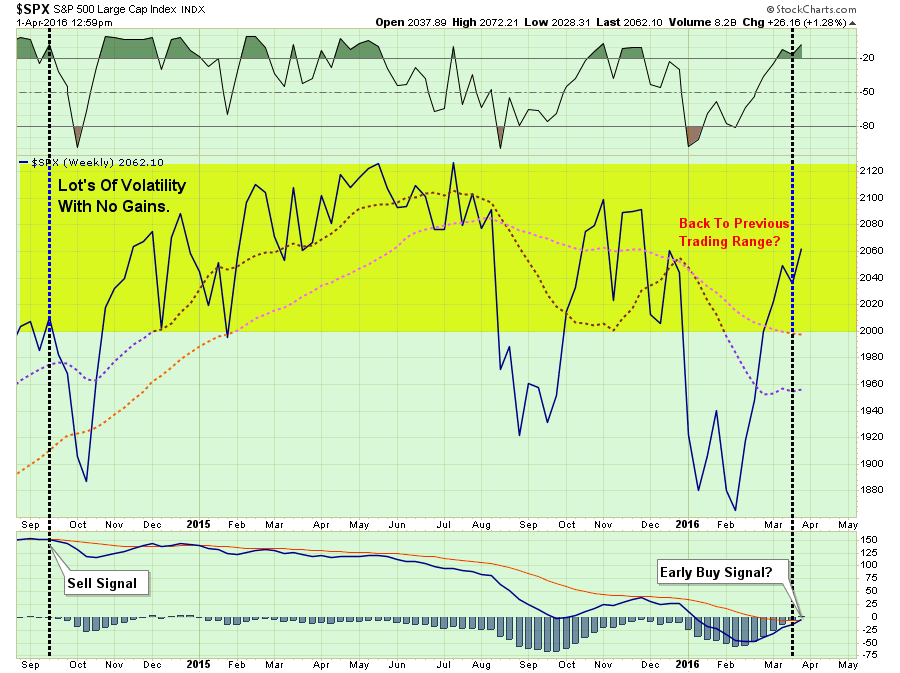

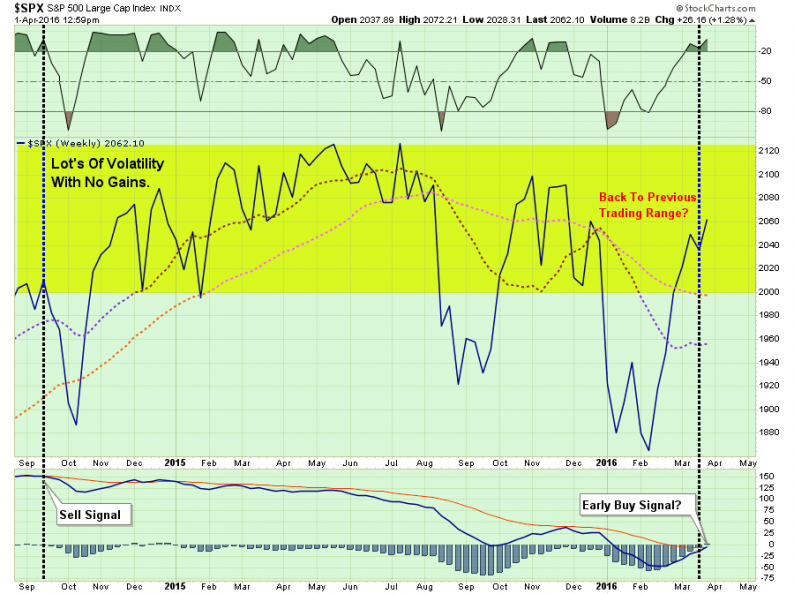

In the chart below, you will note that the previous rallies which took the markets to very overbought short-term conditions (top part of the chart). However, those rallies did not reverse the sell-signal in the lower part of the chart. Each of these previous rallies subsequently failed taking stocks lower. This is why the allocation model remained exposed to lower levels of equity risk during this entire period.”

“Currently, as shown above, the short-term dynamics of the market have improved sufficiently enough to trigger an early “buy” signal. This suggests a moderate increase in equity exposure is warranted given a proper opportunity. However, to ensure that the current advance is not a “head-fake,” as repeated seen previously, the market will need to reduce the current overbought condition without violating near-term support levels OR reversing the current buy signal.

Again, let me reiterate, the commentary above is for shorter-term, active investors, looking for a set up to take on equity risk. There is currently a HIGH PROBABILITY that the analysis above will be reversed in very short-order.

As a portfolio manager for individual’s retirement assets, where risk must be substantially mitigated, there has been NO improvement in the intermediate-term technical structure of the market currently.”

Leave A Comment