In our last installment of Technically Speaking, we discussed the current bullish trend and our price target of 3000 by year end. To wit:

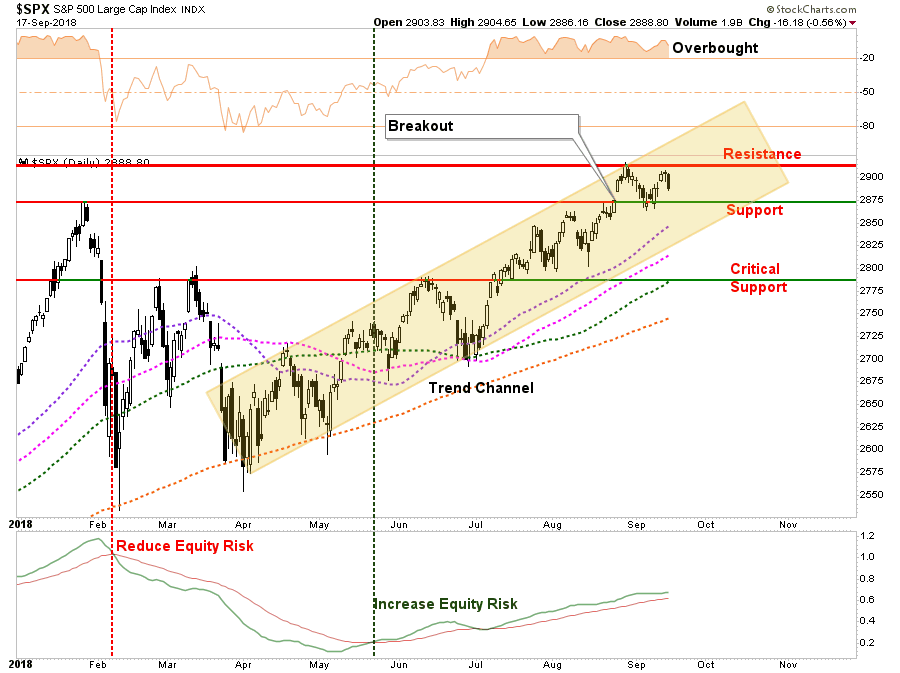

“Regardless of the reasons, the breakout Friday, with the follow through on Monday, is indeed bullish. As we stated repeatedly going back to April, each time the market broke through levels of overhead resistance we increased equity exposure in our portfolios. The breakout above the January highs now puts 3000 squarely into focus for traders.”

Early last week, we used that pullback to support to add equity exposure to portfolios. Again, we are moving cautiously. With the trend of the market positive, we realize short-term performance is just as important as long-term. It is always a challenge to marry both. As I noted on Saturday:

“While we are long-biased in our portfolios currently, such doesn’t remain there is no risk to portfolios currently. With ongoing ‘trade war’ rhetoric, political intrigue at the White House, and interest rates pushing back up to 3%, there is much which could spook the markets over the next 45-days.”

Well, yesterday, the markets got spooked as the President once again ramped up the rhetoric on China instituting another $200 billion in tariffs and threatening $200 billion more if “China retaliates.”

With a double top in place, there is now a building level of overhead resistance traders will have to deal with to move the markets higher. It will be important for the market to consolidate the recent advance above current support. A break of support will likely lead to a test of critical support around 2800.

While a sell-off was not unexpected, we continue to undertake prudent steps in our overall portfolio management process:

Breadth has been weak as of late. Leadership in the FANG’s has fallen off with even the mighty AMZN falling sharply yesterday and breaking its recent uptrend joining the rest of the crowd. Small-cap outperformance has weakened as well.

Leave A Comment