On the “Real Investment Hour” on Tuesday night, I addressed the issue of price versus fundamentals. In the short-term, a period of one-year or less, political, fundamental, and economic data has very little influence over the market. This is especially the case in a late-stage bull market advance, such as we are currently experiencing, where the momentum chase has exceeded the grasp of the risk being undertaken by unwitting investors.

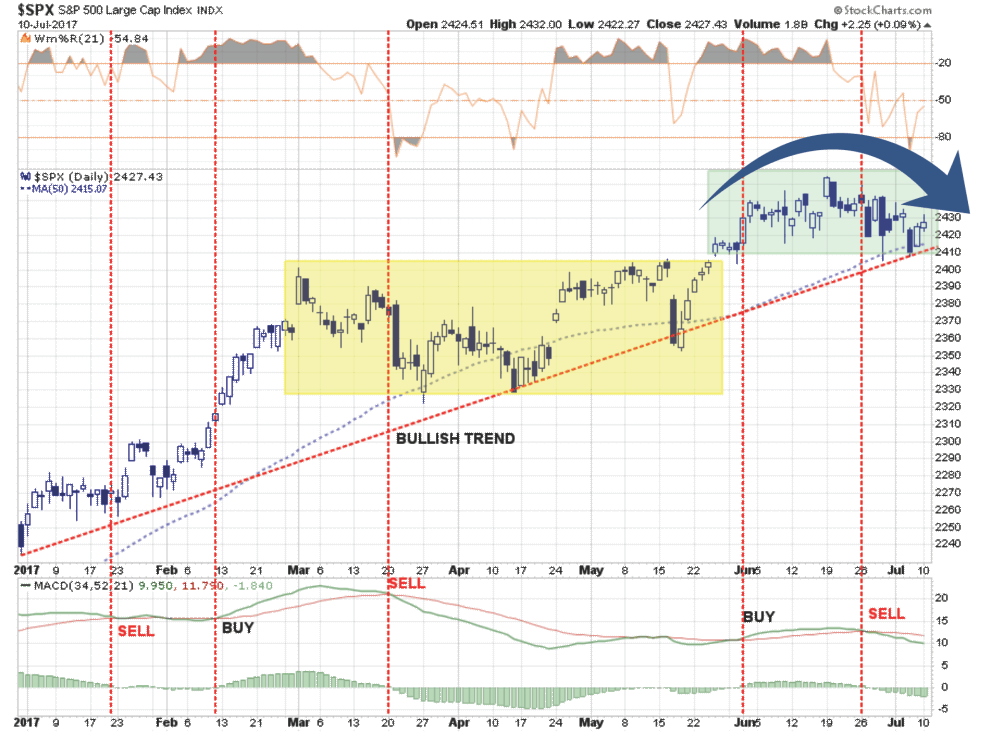

As shown in the chart below, the longer-term price trend of the market remains clearly bullish. However, despite commentary on valuations, sentiment, economics, or politics, the PRICE of the market suggests a weakening trend in investor confidence at current levels. That weakness has also instigated a short-term “sell signal” which suggests prices may struggle more in the days ahead. One thing we need to pay attention to is a potential break of the bullish trend line running along the 50-day moving average. Such a break would likely coincide with a correction back to 2330 in the short term.

Alternatively, if the market can reverse the current course of weakness and rally above recent highs, it will confirm the bull market is alive and well, and we will continue to look for a push to our next target of 2500.

With portfolios currently fully allocated, we are simply monitoring risk and looking for opportunities to invest “new capital” into markets with a measured risk/reward ratio.

However, this is a very short-term outlook which is why “price is the only thing that matters.”

Price measures the current “psychology” of the “herd” and is the clearest representation of the behavioral dynamics of the living organism we call “the market.”

But in the long-term, fundamentals are the only thing that matters. I have shown you the following chart many times before. Which is simply a comparison of 20-year forward total real returns from every previous P/E ratio.

Leave A Comment