My Swing Trading Approach

First, I’ll manage the profits in my existing positions, primarily by raising the stop-losses. Then I will look to add additional long exposure as the market permits.

Indicators

VIX – Major pounding yesterday to bring in the new year, and back to sub-10 readings instantly. Dropped 11.5% to settle at 9.77.

T2108 (% of stocks trading below their 40-day moving average): Respectable rebound of 6.4%. Consolidation has been the name of the game since mid-December.

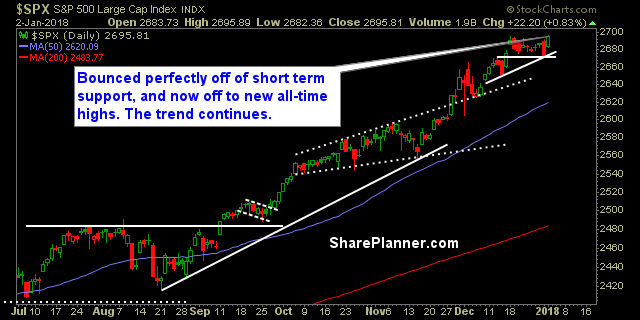

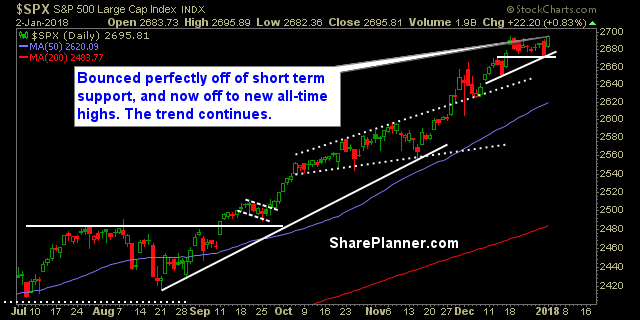

Moving averages (SPX): 5/10 Crossover, reversed back up yesterday, and price reclaimed both moving averages.

Industries to Watch Today

Basic Materials – there is nothing hotter than this sector here. Energy is a close second. Technology bounced back yesterday with vengeance, and now shows signs of life again. Financials, Defensive, Utilities, and Real Estate are looking poor here.

My Market Sentiment

Yesterday’s bounce was important for the bulls, and it keeps the current run going, with the potential for a string a winning days to follow, before the next pullback.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment