Technology Stocks Could See a Sell-Off, Investors Beware

Call me an alarmist, but I believe technology stocks could be worth watching closely. They could be setting up to disappoint. If investors have bought them, it might be time to step back a little.

Over the years, there’s one thing I have learned very clearly; assets that increase in value almost vertically/exponentially don’t remain that way forever. A massive sell-off eventually follows.

The steeper the move to the upside, the more severe the sell-off tends to be.

Why is there a severe sell-off after a rapid move to the upside?

As I have learned, when an asset is witnessing an exponential increase, it means there’s a lot of optimism and excited buying. Also, a lot of so-called “FOMO investors” are jumping to get a piece of the action. Mind you, FOMO means “fear of missing out.”

The FOMO investors tend to be jumpy. They sell at the slightest news. When this happens, you see a snowball effect. All of a sudden, optimistic sentiment turns and excited buying turns into panicked selling.

One of the most recent and best examples of this was Bitcoin and other cryptocurrencies. Cryptocurrency prices went up way too quickly. Everyone thought that they could continue to go higher.

After a rapid move to the upside in Bitcoin prices, we saw panic kick in and a massive sell-off followed.

iStock.com/ipopba

The Last 2-3 Years Were the Best Time to Buy Amazon Stock…

With that said, know that a few of the biggest technology stocks are witnessing exponential moves to the upside. If an investor is becoming complacent about them, they could be making a big mistake.

It really has to be questioned if a sell-off is looming for technology stocks sooner than later.

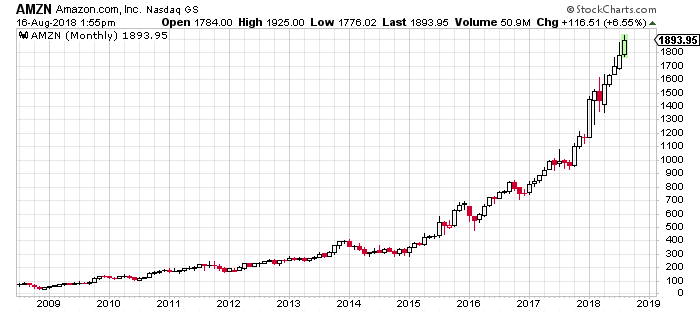

Consider the chart below of Amazon.com, Inc. (NASDAQ: AMZN). The exponential move in AMZN stock began two to three years ago.

Chart courtesy of StockCharts.com

Leave A Comment