Facebook’s 2018 Spending Growth Disappoints

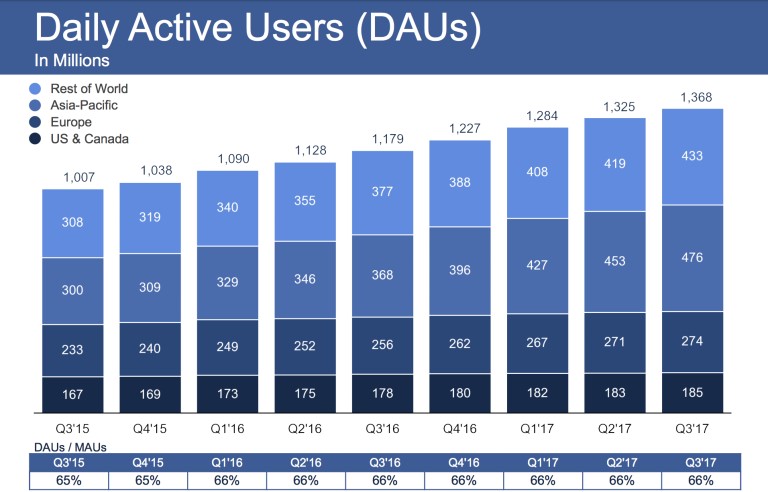

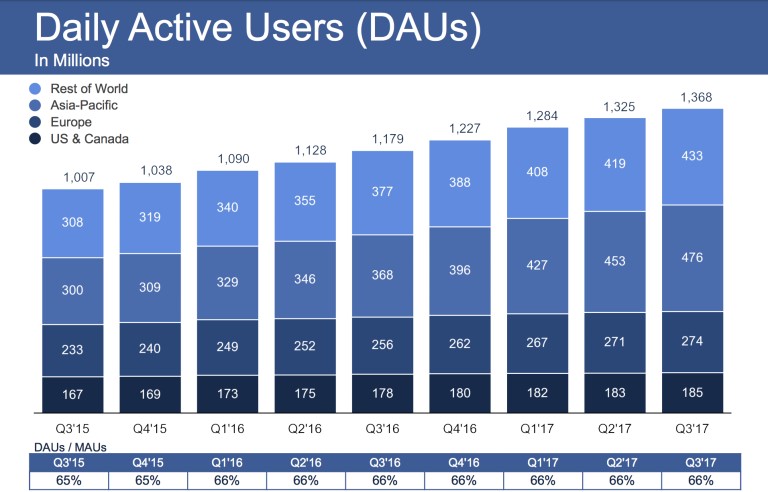

Facebook – FB reported earnings on Wednesday; it’s the second to last major tech firm to do so. Apple will be the last one on Thursday. Tech is about 24% of the S&P 500 and it’s about 24% of total earnings. Facebook reported a great result, but was hindered by the estimate for 2018 expenses. The stock ended up falling 1.87% in the after hours market. I wouldn’t be surprised if it fell further on Thursday because it’s at its all-time high. The company reported $1.59 in EPS which beat estimates for $1.28. Revenues were up 47% to $10.3 billion, beating estimates for $9.84 billion. Monthly active users were 2.08 billion which beat estimates for 2.07 billion. As you can see in the chart below, daily active users were 1.368 billion. It’s amazing to see daily active users in America and Canada were up about 4% year over year which is impressive given the saturation. Daily active user growth as a whole was up 16% year over year. This is no longer a user growth story as it’s unlikely the company will match that growth next year given that the number of users is closing in on the number of people with internet access.

As I mentioned, the company’s spending guidance hurt the stock. It wasn’t pleasant to hear Zuckerberg say protecting the community is more important than profits. Obviously, user experience is critical, but the way he phrased it means profits will be less than they would have been without these new changes. The company is doubling the number of workers who keep hate speech and fake news off its sites to 20,000 by the end of the year. Capex will also double because of more spending on security and original content. Because Facebook has seen a decline in original posting, the company needs to pay for live shows and other content to get people to stay on the site. The company is in a better situation than Twitter obviously because at least it makes money per user. Either way, this is still a new risk the company faces because it could have sunk costs from failed shows.

Leave A Comment