Moments ago, the most hyped stock in the market announced Q3 results… and missed while burning a record amount of cash; however Musk’s contagious optimism once again dominated the outlook and as a result the stock is up by 7% after hours.

The quarter highlights:

Telsa delivered 11,603 vehicles in Q3

Q3 non-GAAP gross margin 25.1%, dropping from 29.4% a year ago; adding “we expect non-GAAP Automotive gross margin to decline slightly from Q3″

The company trimmed its own guidance for full year deliveries from 50,000-55,000 to 50,000-52,000

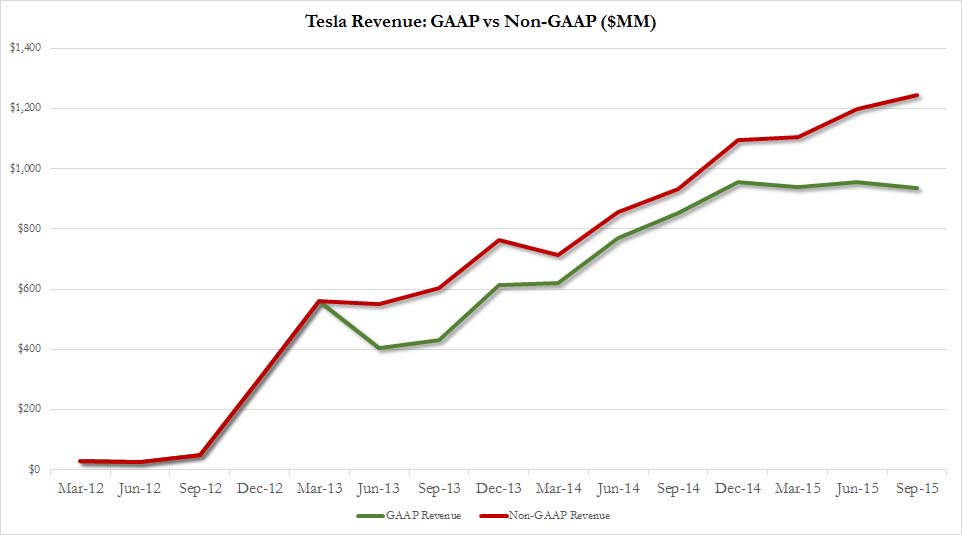

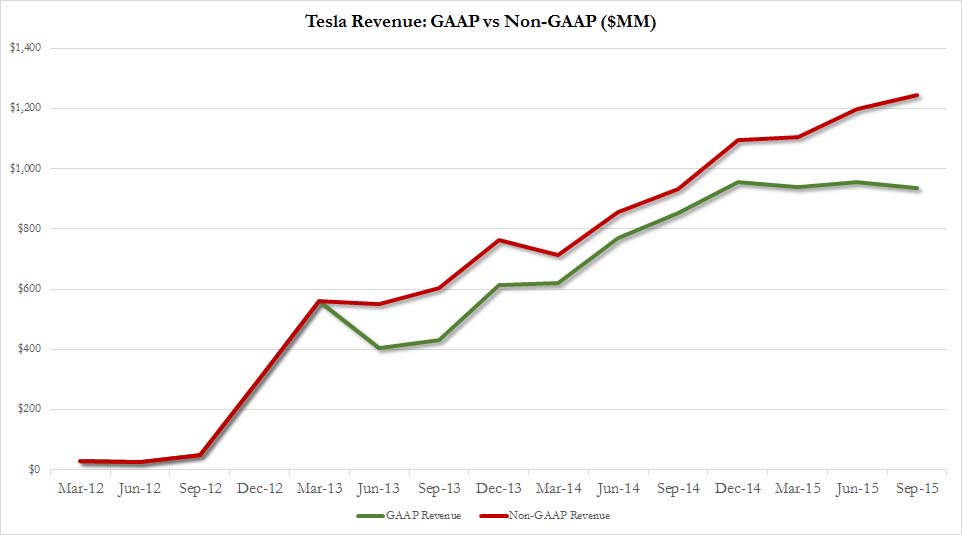

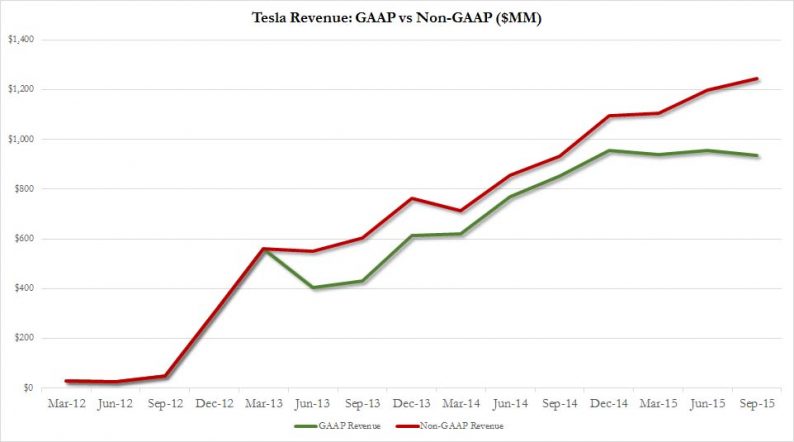

Non-GAAP Revenues of $1.24 billion came in line with estimates, although something strange emerged: while non-GAAP revenue rose from Q3 by about $50MM, its GAAP revenue actually declined by $18 million to $937MM. The difference: a surge in “revenue deferred due to lease accounting” which soared from $242MM in Q2 to $307MM in Q3.

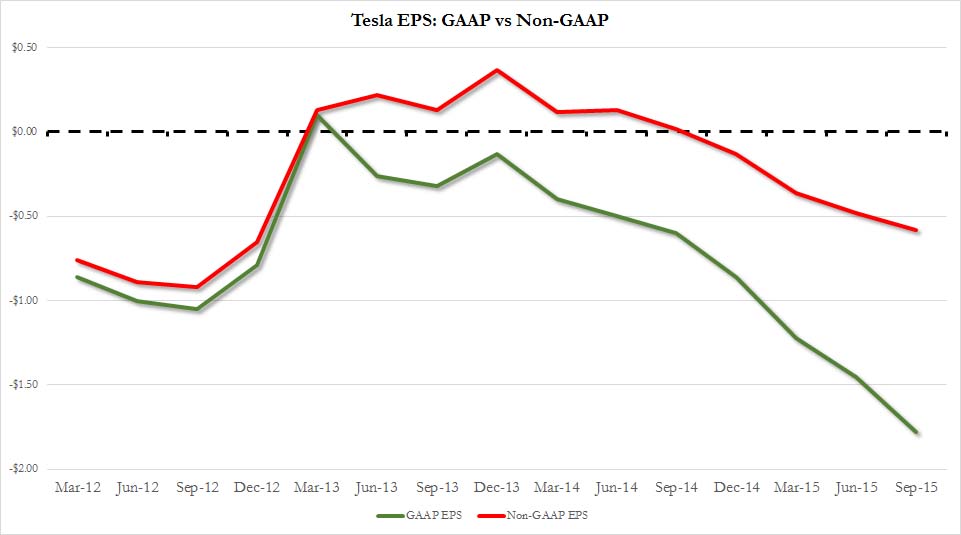

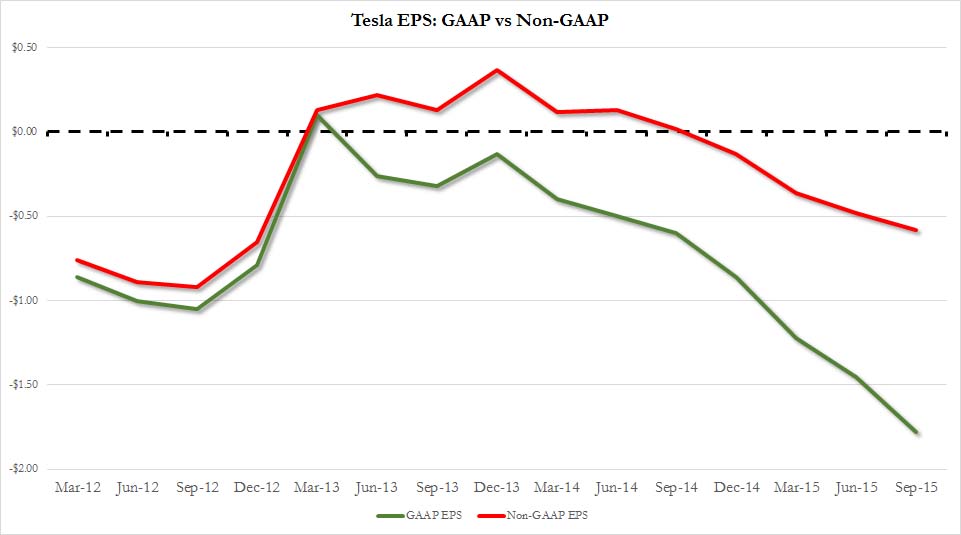

Non-GAAP EPS of $(0.58) missed expectations of a ($0.56) print. GAAP EPS was a disastrous (1.78)

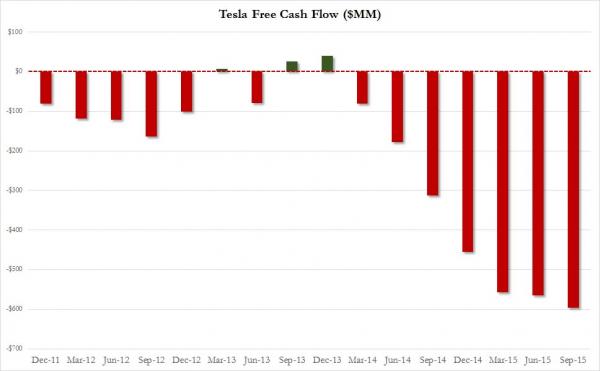

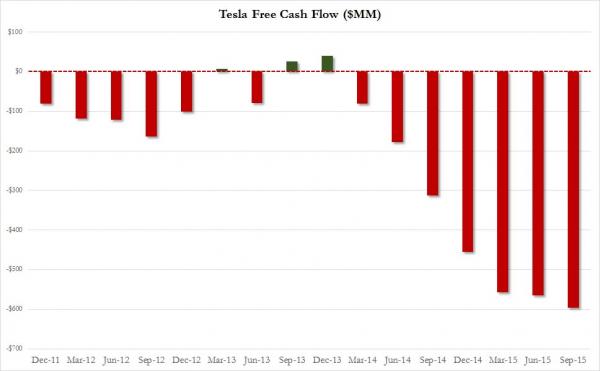

But most troubling, as usual, was the ongoing cash burn from a company which appears allergic to generating any positive cash flow. At ($595) million in free cash flow, this was the worst cash burning quarter in Tesla history, which supposedly was to be expected with the rollout of the Model X.

The results in charts:

Revenue: both GAAP and non-GAAP:

EPS: both GAAP and non-GAAP

And Free Cash Flow:

And yet, despite what were clearly disappointing historic results, the stock is up 7% after hours. Why? One simple reason: its forecast was as usual, bullish.

The company sees 17,000-19,000 deliveries in Q4, which was modestly higher than the consensus estimate of 16,500

It plans to invest $500MM in Q4 raising full year CapEx from $1.5 billion disclosed previously, to $1.7 billion now.

Some more of Musk’s infamous bullishness (and blaming production bottlenecks):

Leave A Comment