Tesla Motors (TSLA) the electric car company looking to change the world by ending our reliance on oil needed to fuel the internal combustion engine has had a crazy couple of months.

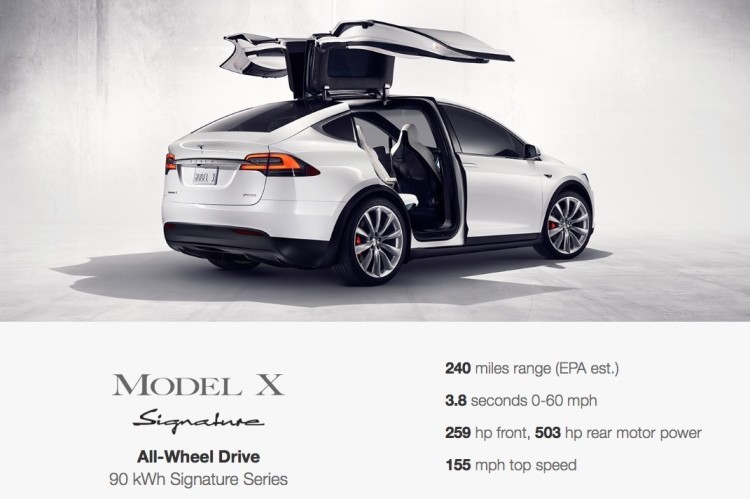

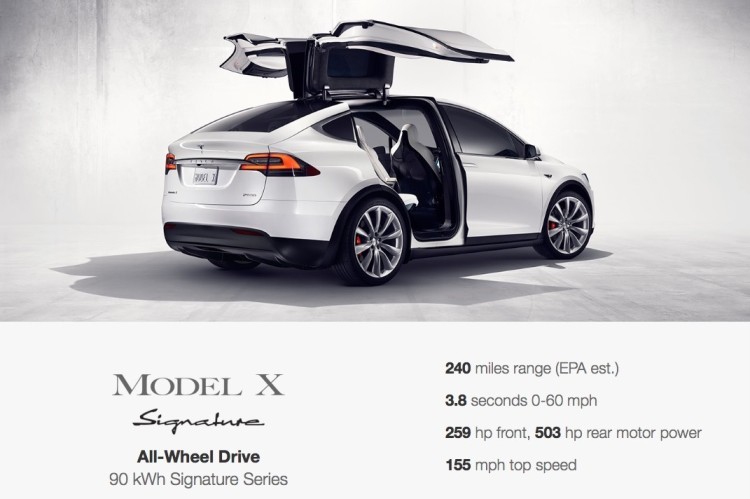

At the end of August Tesla’s all-wheel drive version of the Model S, the P85D, broke the Consumer Reports record where it earned a score of 103 out of 100. Around the time that Consumer Reports referred to the model S as the “best performing car we have tested”, Tesla was trading at $242.99, and things seemed great for investors. A month after this stellar review, Tesla announced the Model X, their revolutionary sports utility vehicle designed to be twice as safe as the next safest SUV. Another major event in the realm of Tesla was the October release of the autopilot feature, which was sent to approximately 40,000 vehicles over the air. With autopilot, Tesla vehicles were given the ability to steer, merge lanes and parallel park autonomously.

In early October, however, Tesla started to hear from its doubters. Shares fell down to $220.69 on October 9th as multiple Wall Street analysts downgraded the stock. Brian Johnson from Barclays lowered the price target from $190 to $180 saying that he was unsure if Tesla is able to successfully become a mass-market producer. Ben Kallo from Robert W. Baird & Co. lowered his price target to $282 from $335, as a result of skepticism towards Tesla’s ability to manufacture both the Model X and Model S in the same Fremont, California factory. The most bullish Tesla analyst, Adam Jonas from Morgan Stanley cut his price target from $465 to $450 citing concerns about the Model X’s price. Jonas explains: “Unless Tesla introduces significantly cheaper versions soon, we do not expect the company to deliver more than 20,000 units of Model X in 2016.”

Further Tesla criticism came from billionaire Jim Chanos who on October 12th went on Bloomberg to claim that Tesla is an overpriced car company and that they are unable to scale up their operations in order to compete with other auto manufacturers, such as BMW that sell two million cars a year. Other concerns about Tesla resulted from valuation and the fact that Tesla is trading at 7.5 times sales. The argument was made that Tesla’s approximately $30 billion market cap cannot be justified by Tesla’s sales of around 50,000 cars.

Leave A Comment