Given the current market volatility it makes sense to look for stocks with stability. And if you are looking for stocks with consistent growth and a favorable outlook then you are in luck. Indeed, all three stocks highlighted below have a ‘Strong Buy’ analyst consensus rating.

Let’s take a closer look now:

1. Mastercard (NYSE:MA)

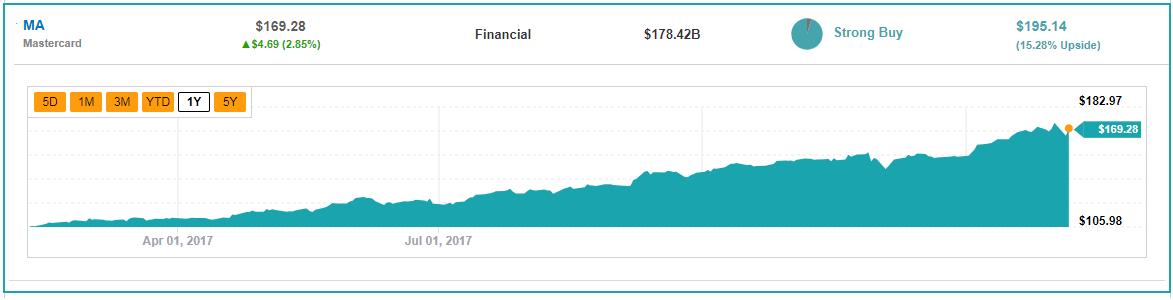

Global payments giant Mastercard has seen shares rise from $106 to $169 over the course of the last year. And as we can see below analysts are predicting further upside of over 15% from the current share price. Indeed, the stock has received a slew of bullish buy ratings from analysts in the last week following solid 4Q17 earning results. Note that you can click on the screenshot for further insights into the stock’s latest ratings.

Oppenheimer’s Glenn Greene (one of the top 5 analysts on TipRanks) has just reiterated his buy rating with a $182 price target. He views shares as ‘attractively’ valued right now and is further encouraged by recent strong revenue/volume growth. Looking forward, he is also confident that the company is well-positioned to continue its growth trajectory and says:

“We are highly attracted to MA’s powerful brand, vast global acceptance network, and strong business model. We believe the company is well positioned to benefit from the long-term secular shift from paper currency (cash/check) to plastic (electronic payments) and growing consumer consumption.”

2. Interxion Holding NV (NYSE:INXN)

This top stock is a key European provider of cloud and co-location services. Currently, INXN supports about 1600 customers in over 40 data centers- but aggressive expansion is now on the cards. Oppenheimer’s Timothy Horan points out that INXN has just announced the largest capacity expansion in its history, which he sees as evidence of intensifying demand across Europe. He now expects INXN to add 17K square meters of capacity a year in 2018-19 and says: “INXN is a critical piece of the overall cloud ecosystem in Europe. Europe is in the early stages of cloud adoption; we see a long runway for growth.”

Leave A Comment