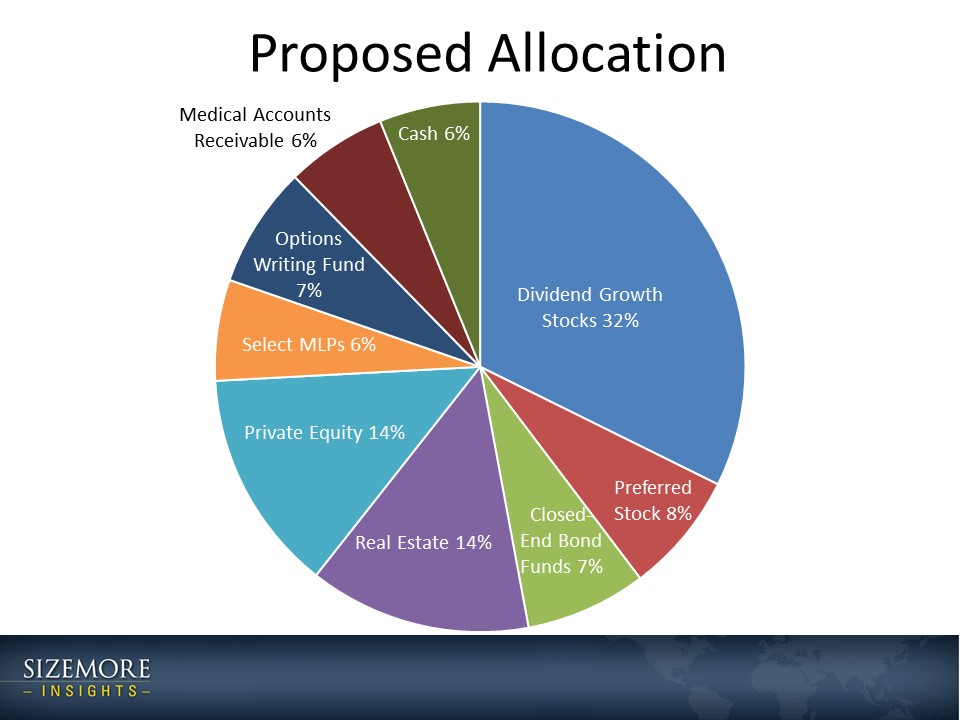

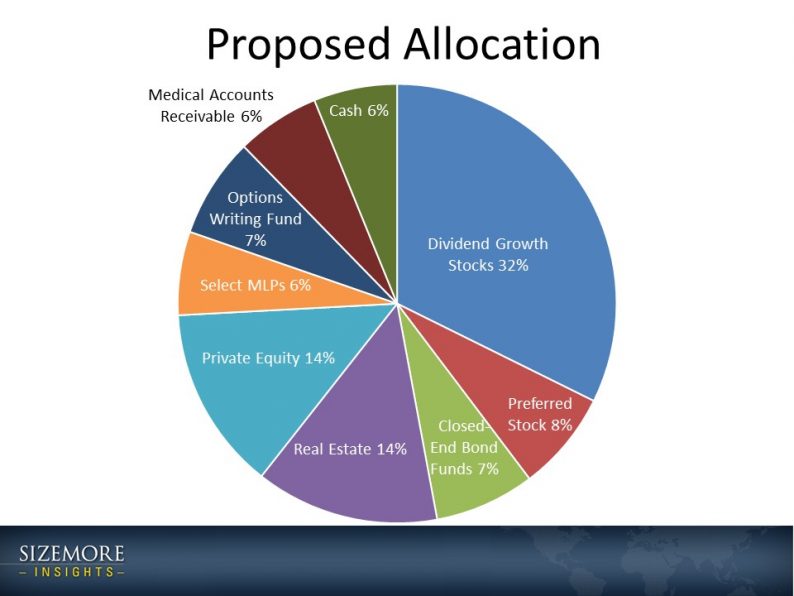

The following is a proposal I put together for a new client:

As you can see, we do things a little differently around here. Traditional stocks make up less than 40% of the portfolio, with the rest sitting in non-correlated assets outside of the stock market. We invest in everything from options-writing funds to medical accounts receivables and everything in between. The result is that we get most of the safety you would expect from a 60/40 stock/bond portfolio but without the loss of expected return. Our goal is to give you stock-like returns with the risk profile of a blended portfolio.

Why Invest in Alternatives?

You probably have a good grasp of why diversification is important. Throwing out the financial jargon, it essentially boils down to not putting all of your eggs in one basket. But it also gets a lot more sophisticated than that. Many investors feel that they have adequate diversification because their assets are spread across several stocks or mutual funds. And to an extent, they are right. Owning multiple stocks reduces the risk of downside from any single position.

But there is also a major problem with this: Correlation.

If Apple (AAPL) and Microsoft (MSFT) stock prices move together in lockstep, you’re not really getting much in the way of diversification by owning both. And in a real bear market, virtually all stocks drop together.

True diversification means owning assets that do not move together. Investment A can go up, down or sideways, and it should have little or no impact on Investment B.

This is where the beauty of an alternative portfolio comes into play. We can achieve “stock like” returns in the range of 7%-10% per year without the volatility that comes with stocks.

Why the 60/40 Portfolio is Dead

Alternative assets weren’t particularly popular in 1980. There is a reason for that. Back then, traditional bonds offered a respectable return. A blended 60/40 portfolio of stocks and bonds offered a solid expected return.

Leave A Comment