As 2015 comes to a close, we take a look back at the biggest earnings surprises of the year.

Amazon (AMZN)

Consumer Discretionary – Internet & Catalog Retail | Reports FQ4 2015 results January 28

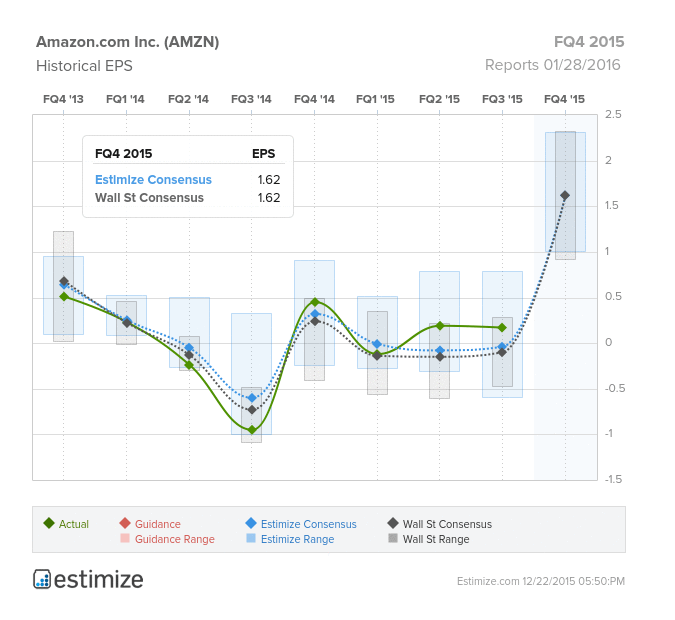

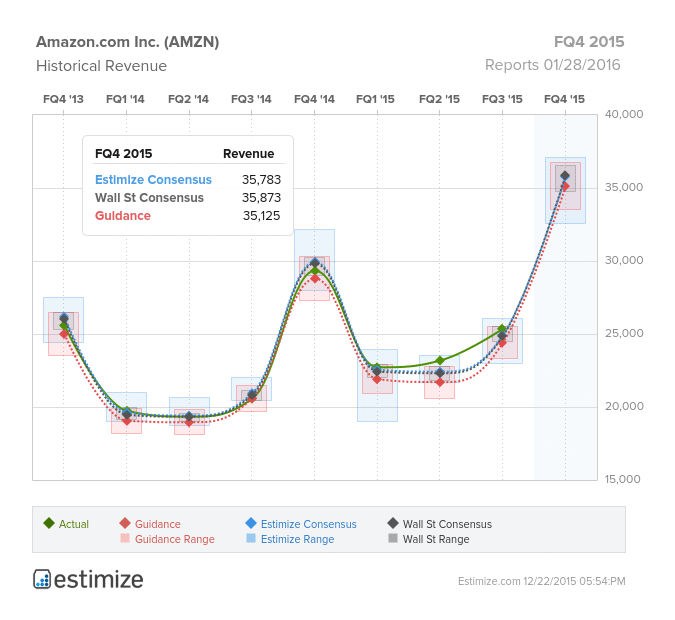

It’s no secret that over the past couple of years Amazon has had a spending problem related to poor investments, such as the Amazon Fire Phone. It was misses such as this that led to four straight quarters of EPS declines from Q2 2014 – Q1 2015. After starting out 2015 on a down note, with first quarter EPS coming in at -$0.12, 11 cents lighter than the Estimize consensus, the company had a surprising recovery in the second and third quarters. Earnings per share exceeded expectations by 27 cents in Q2 and then 21 cents in Q3, all the while posting double-digit revenue improvements as well.

This year seemed to mark an inflection point for Amazon as the unquestionable leader in the ecommerce space, almost solely responsible for the downfall of big box giant, Walmart. On October 14 Walmart blamed its lower 2015 guidance on wage hikes, but anyone paying attention to this story knew the retailer was raising the white flag in its losing Amazon battle. Retailers are doing their best to price match, but can’t keep up with Amazon’s Prime offering. Prime customers are incentivized to use their service to get great deals, free 2-day shipping, streaming videos and even online cloud storage. Amazon’s Prime Day sale held in July topped expectations and drove record revenues during a normally slow period. The company raked in 34.4M orders, an 18% increase from Black Friday 2014, and a 266% increase in worldwide orders.

2016: All these factors have helped lift the stock by more than 100% in 2015, and a strong holiday season is expected to carry Amazon into the new year. Analysts currently expect triple-digit profit growth in the first three quarters of 2016, with Q4 dropping to the high double-digits.

Leave A Comment