Ok, BofAML is out with another one of their surveys (they conduct a lot of them) and the results contain some possibly useful tidbits and at least one pretty amusing visual anecdote.

Now one thing to note, before we get into that, is that BofAML’s Adarsh Sinha doesn’t seem to be as optimistic as his tarot-card-reading colleague Stephen Suttmeier, who was out with this bit of line-based prognostication on Friday:

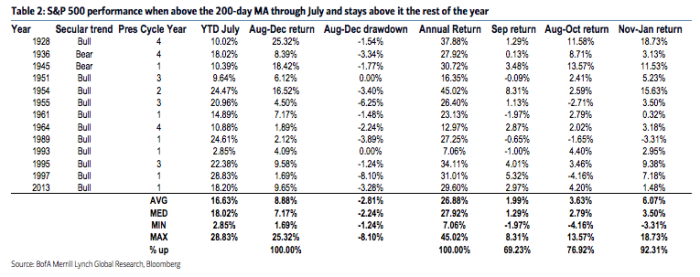

Scenario 2: Stay above 200-day MA

Above MA through July but stays above the rest of year

The second and slightly less likely scenario when the S&P 500 has not had a YTD daily close below its 200-day MA as of the end of July is staying above this MA on a daily closing price basis for the rest of the year. This implies minimal impact from bearish August-October seasonality and a continued strong uptrend. This scenario has 13 observations. The August-December and annual returns are positive 100% of the time. Dip to 2415-2400; year-end upside to 2647-2690 & 2800+

Meanwhile, back in the real world where lines are just … well, just lines … the above-mentioned Adarsh Sinha has this to offer:

The market optimism implied by our factor analysis also means that the bar to positively surprise expectations has ratcheted higher. This is best captured by global data surprises that have collapsed towards zero in recent months, arguably driven by upward revisions to expectations rather than actual weakening of data outcomes. Along with positioning, this explains the heightened sensitivity of the rates market to negative data surprises.Moreover, it is hard to see global stocks performing well if data surprises turn negative (Chart 3).

So you can draw your own conclusions about who to believe there.

As far as the bank’s clients go, here are the responses from the latest FX and Rates survey question “What are you most concerned about over the next three months“:

Leave A Comment