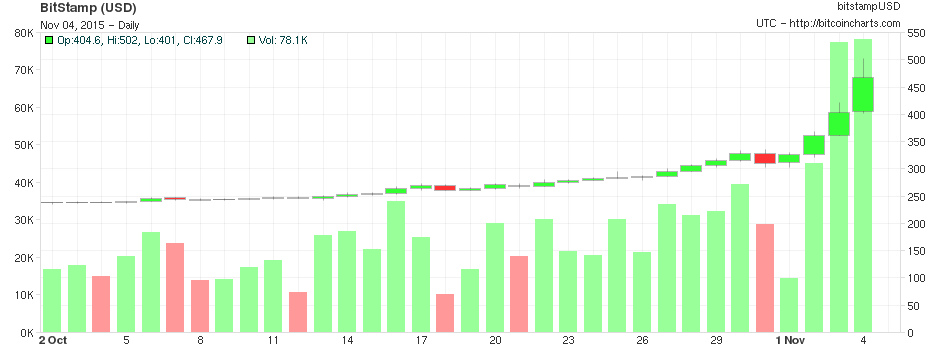

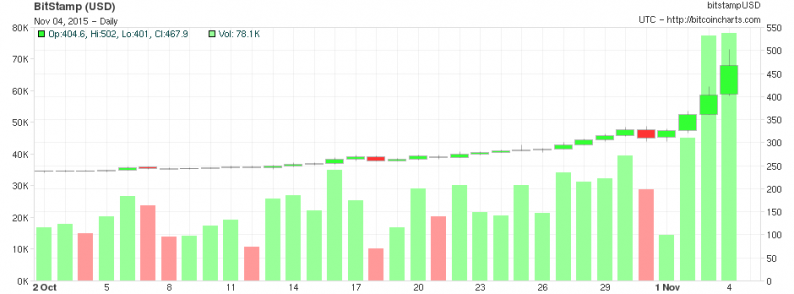

The Bitcoin price has more than doubled since the start of October, up from $236 to $475 as I write this article. Showing increased volatility, the price briefly climbed above the $500, before correcting back towards $450 and bouncing again to $475 today.

The rally is being driven by the Chinese buyers seeking to protect their wealth from capital controls and be able to move it freely outside borders. The buying is so frenzied that Bitcoin trades at a premium of 10+ or more Chinese exchanges versus U.S. exchanges. Some Chinese banks have also made it easier to buy Bitcoin recently. They are now accepting direct deposits (making it significantly easier for Chinese to rotate their Yuan deposits into the virtual currency).

Buyers are scrambling to get their hands on a limited number of Bitcoin in circulation and pushing the price rapidly higher. Another reason for this sharp price increase is the fact that most of the remaining holders are strong hands, as speculators have long ago left the market. They believe in the technology and long-term promise of the crypto-currency and the blockchain technology. They aren’t looking to trade in and out, making it harder to find sellers when a rush of new buyers enter the market.

The exploding volume in China and rapidly rising prices has also led to a spike in volume on U.S.-based exchanges. Speculators are rushing to get their hands on the currency and pushing prices even higher. Bitcoin has a long way to go before returning to the previous high around $1,150, but some are already speculating that the next move higher will easily surpass the previous high and push the price to $2,000 at a minimum.

It is hard to say where the price will go next, but I have been accumulating over the past week with the expectation that this rally is just getting started. A recent Goldman Sachs survey of 752 millennials found 44 percent said they have used, do use or will use bitcoin. And more than 100,000 merchants world-wide accept bitcoin for at least some payments.

Leave A Comment