Brazilian stocks closed out January on an impressive run. Like stock markets all over the rest of the emerging market economies, Brazil’s has been on fire. The Sao Paolo Bovespa stock index had stumbled a bit in the middle of December, coinciding with a drop in the real against the dollar in that fit of global illiquidity, but between December 14 and the most recent peak on January 26, the index gained an impressive 13,102 points. That’s +18% in a little over a month.

Going back coincidentally to January 26, 2016, Brazilian stocks in the Bovespa have gained 128% in two years. That’s the kind of returns EM investors have been expecting and were once taken for granted.

Given the “wall of worry” even for riskier emerging market stocks, it would seem those returns anticipate complete recovery for more than Brazil. They are almost surely the fruits of “globally synchronized growth” that will benefit the BRICs above all others. A resurrection of the precrisis global model would seem appropriate, the impetus behind the rocket-like ascent going on in Sao Paolo.

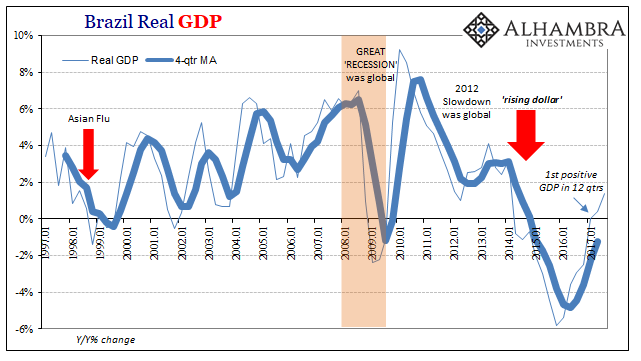

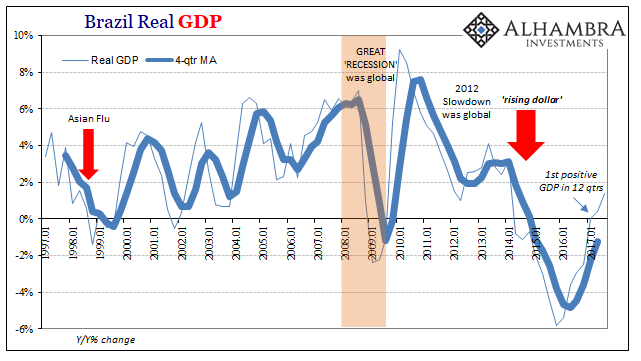

The economic statistics coming out of Brazil have been encouraging. Real GDP which had contracted for an astonishing twelve straight quarters is now positive for two in a row (through Q3 2017). In the third quarter of last year, GDP gained 1.4% year-over-year. Like you’ll hear about a lot of other statistics around the world, that’s the highest growth rate in more than three years.

It’s not that 1.4% is by itself the basis for surging stock prices, it’s the straight line upward the positive number supposedly represents. In the grand scheme of things, 1.4% is surely just the first stop on the way to 3.4%, 5.4%, and eventually 6.4% or 8.4% like the good ol’ days, right?

The mentality driving the Bovespa is the assumed probability that’s the correct interpretation. If Brazil is righting itself, better get in now before it actually happens lest one miss out. It’s a game of probability, and right now it’s hard to find anyone down on the Brazil and the EM’s.

Leave A Comment