With Brent Crude oil driving higher on Wednesday — up nearly $1 and trading at $67.59 in early afternoon New York trading – Morgan Stanley analysts Martijn Rats and Amy Sergeant point out that European refining margins have weakened recently. This is creating a negative correlation, where refining stocks head lower as the underlying product, Brent crude, moves higher.

Brent crude: Watch for trading range with $70 high

With the primary pipeline distributing Brent crude just recently opened and the futures contract in backwardation – the front month is trading higher than the back month — Francisco Blanch, head of commodities research at Bank of America Merrill Lynch, sees a trading range for Brent in 2018 – touching the $70 level but averaging $56, nearly $10 off the current price.

The backwardation could be due to near-term supply concerns, with pipeline flow stoppages and what Morgan Stanly analysts Rats and Sergeant “limited product stocks,” oil prices could be buoyed in the coming year – assuming too much additional production capacity does not come online.

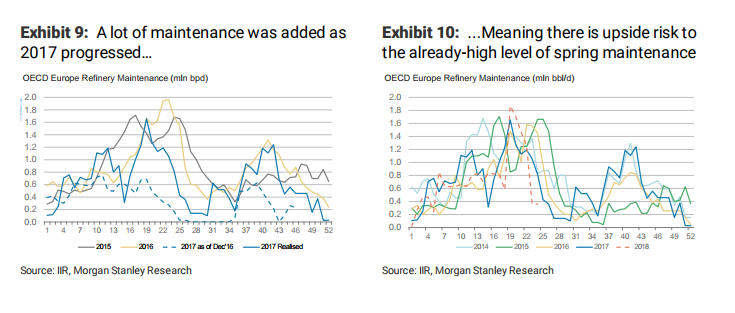

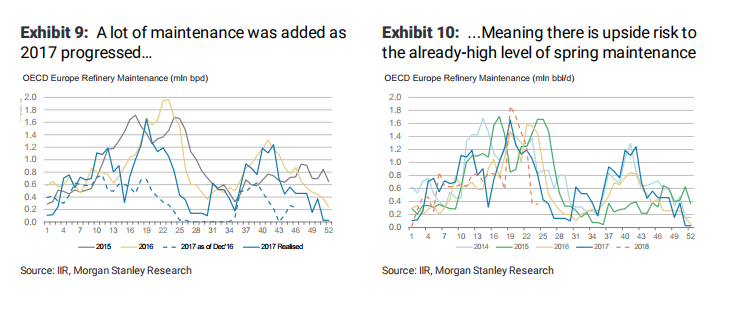

On a near-term basis, Rats and Sergeant look at an unusually large amount of refinery maintenance planned in the first half of 2018 as a weight on the scales of supply and demand. “European refiners already plan to take as much capacity offline for maintenance during the Mar-May period as last year,” they wrote in a January 2 report. “Those plans usually expand further as time goes by, but they already suggest that as much as 1.5 mb/d could be offline in May – approximately 11% of total European capacity.”

The move higher in price may create a self-fulfilling prophecy. With oil crossing the important $66 benchmark, previously shuddered shale oil platforms are likely to come back online, creating more supply and thus lower prices – eventually. “The U.S. shale-OPEC tug of war will simultaneously cap upside price potential and downside risks,” Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London, told Bloomberg.

Leave A Comment