The cocoa market has a soft spot in my heart. It was the first commodity I ever concentrated on, and I have continued to follow it all these years. My first real job in commodities was as cocoa analyst for MARS Inc., the privately help candy company. BTW, MARS was a truly excellent company and probably still is. The big reason for this was (is?) guidance from a really smart family that takes a multi-generational outlook. I doubt if they will ever IPO, but if they do, I’m in.

Anyway, there are a few structural issues in cocoa that make it somewhat unique:

Cocoa is a tree and it takes 6 -8 years from the time prices provide incentive for an increase in plantings until you start getting substantial production from the new trees. Say one to two years for the plantings to occur and another five or so for the trees to mature. Once the tree has matured cash costs for harvesting are very low. So cocoa can and does have multi-year cycles, like oil.

Cocoa fundamentals are exquisitely researched by the major participants in the industry. The large candy companies have staffs continuously examining the trees in the major growing regions. They see even minor effects of weather or disease quickly. Some of the large trade houses also do this research, but on a smaller scale.

Cocoa speculators are generally technical. This makes sense; it’s more difficult and costly to get fundamental info than in say, corn or soybeans. So technicals are all they have. This mostly means they follow trends.

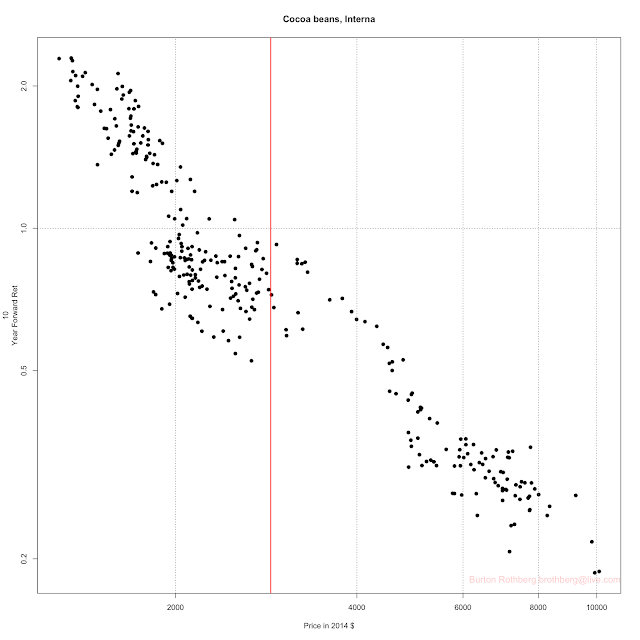

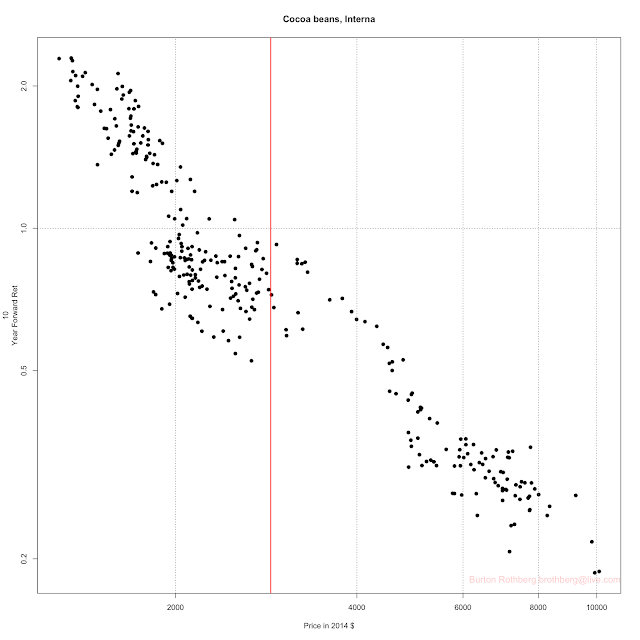

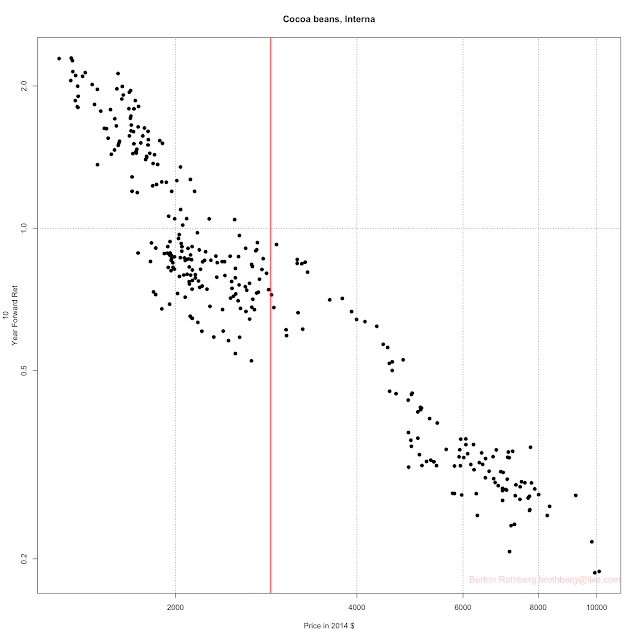

Let’s start with the long run position of cocoa using the ten-years graphs. Click herher for an explanation.

Leave A Comment