Yesterday the Dow Jones crossed above 25,000 for the first time ever, making the trek from the previous millennial level of 24,000 in just 23 days: a record short interval of time. There was just one problem: retail investors refuse to get on board for the voyage.

Ah yes, retail investors: long beloved on Wall Street because they miss every equity bull market then inevitably join the party too late and serve as the buyers of last resort that soak up the supply of overvalued garbage being dumped by hedge funds, banks and other institutions at end of every bubble. Showing up to the party too late and then riding the crash is just kinda their thing.

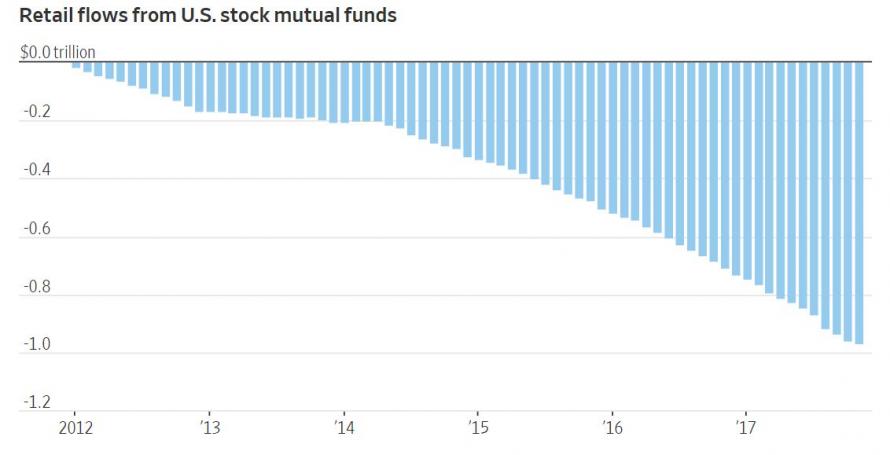

As the Wall Street Journal points out this morning, that cycle appears to be repeating itself with the current equity bubble. Well, only the first part, because no matter how high the market rises, retail investors just can’t stop selling. In fact, since 2012 retail investors have pulled nearly $1 trillion in capital from U.S.-focused mutual funds.

… even as the S&P has nearly tripled.

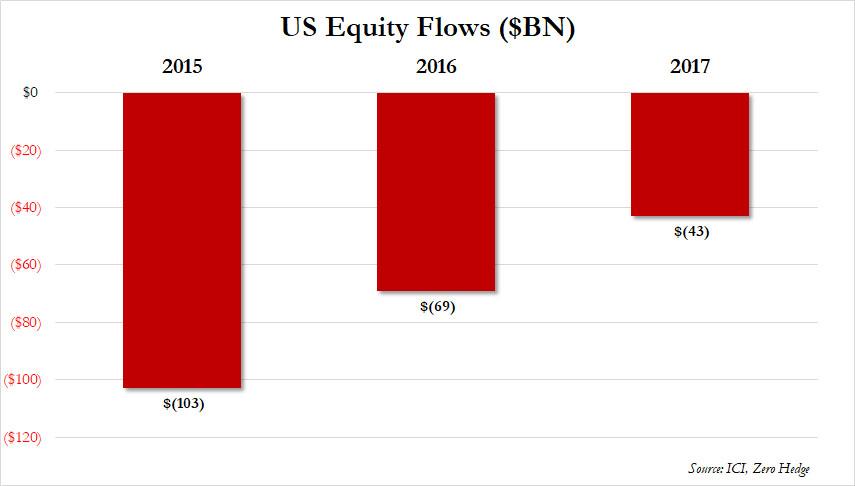

Incidentally, this is what we noted at the end of 2017 as the biggest mystery and lingering question on traders’ minds: how is it possible that while the cumulative return of the S&P since 2015 been an impressive 34%, equity flows over the same period have been consistently negative?

Aside from corporate buybacks accounting for the bulk of purchases (and central bank purchases of course), we have yet to hear a plausible explanation for how any of this makes sense. Speaking of buybacks, here is the WSJ:

The most dedicated buyer of U.S. shares has been the companies themselves. Corporate stock buybacks started ramping in 2009, hitting a record of $572 billion in 2015, before leveling off, according to data from S&P Dow Jones Indices. With the new tax law cutting the corporate rate to 21% from 35%, many analysts expect companies will use at least some of that cash to buy back more of their own shares.

Leave A Comment