The Everything Bubble is bursting.

After the 2008 Crisis, global central banks created a bubble in the sovereign bond market via ZIRP and QE. Because these bonds are the bedrock of our current financial system, when Central Banks created a bubble in this asset class, they were effectively creating bubbles in EVERYTHING.

That bubble is now bursting.

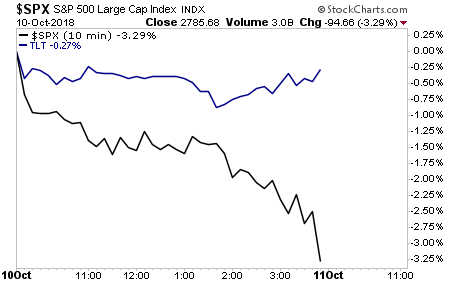

Historically, when stocks collapse as they did yesterday, the bond market rallies. Not yesterday. Both stocks AND bonds finished the day DOWN.

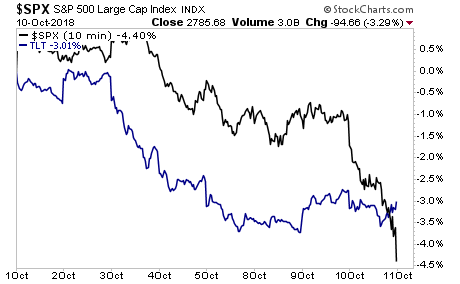

Unfortunately, yesterday was not an anomaly. Both bonds and stocks are DOWN for the month for October thus far.

This signals a tectonic shift. Throughout the post-2008 era, anytime stocks collapsed, money rushed into bonds.

Not anymore. Indeed, the bond market is now collapsing ALONG with stocks. The yield on the most important bond in the world, the 10-Year US Treasury, has broken its multi-decade trendline.

If you aren’t actively taking steps to prepare for this, you need to start NOW.

Leave A Comment