As we all wonder what to do with the mini “tech wreck” that is upon us, it is helpful to step back and check the big technical picture of this group. The group could be defined as big cap growth, not necessarily tech, that has produced a handful of big growth superstars. These stock climbs will sometimes produce a technical condition known as the ascending wedge, which is bearish, and typically result in a trend change, either to a stagnation period or a protracted decline.

To illustrate, let’s look at a good growth stock of the recent past that can seemingly do no wrong – Tractor Supply (TSCO), the specialty “recreational farming” supply retailer. If you have ever worked on a small farm like I have, you wonder why they call this “recreational”. They have somehow escaped the Amazon squash with their results, but the stock went into a wedge and was squashed anyway:

What is especially bearish is when the A/D trend (upper graph) is broken in conjunction with a wedge. In TSCO’s case the trend was blasted with the monster gap down move, and you had no chance to get out ahead of the damage. When this is more gradual, the warning should be heeded.

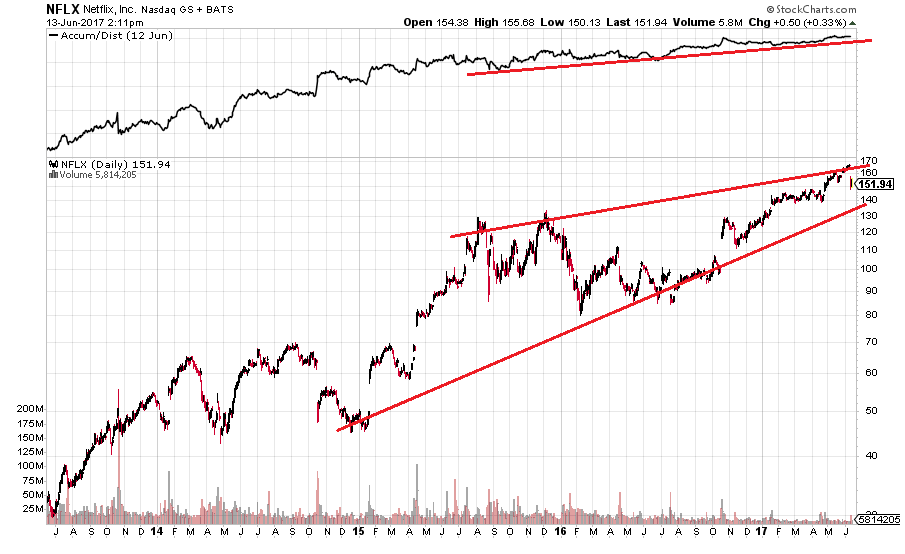

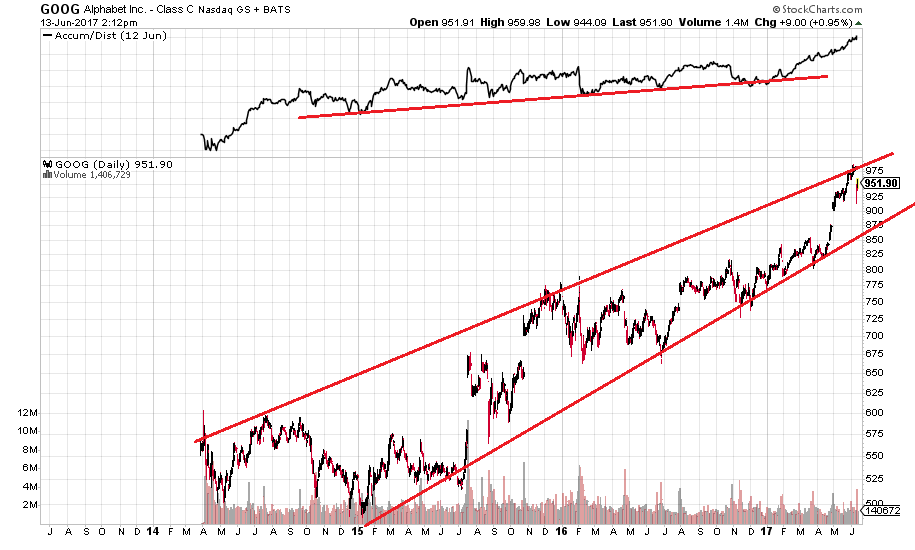

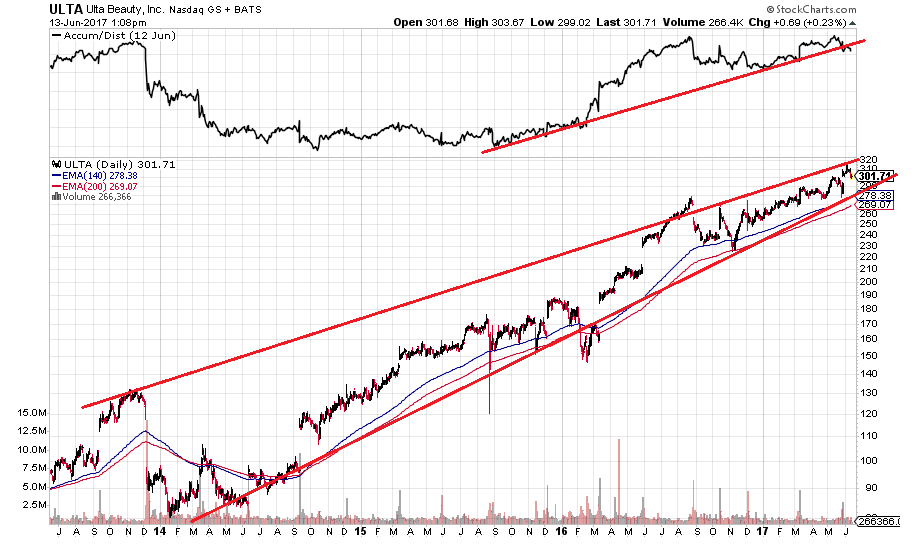

So where is the FANG gang in relation to the ascending wedge? Not in a good place:

Here we see Netflix (NFLX) earnestly tracing out a wedge, but the A/D trend is intact.

Google (GOOG) is also wedging but with no A/D problem. But stocks often break the wedge before they break the A/D trend, as TSCO did above.

An honorary FANG stock outside of tech is ULTA, the make-up and beauty supply growth beast. It is forming a wedge and also threatening an A/D breakdown as well.

Apple (AAPL) isn’t forming a wedge, but it hasn’t had much of a chance having broken out of a big downtrend just this year. But Facebook (FB) is:

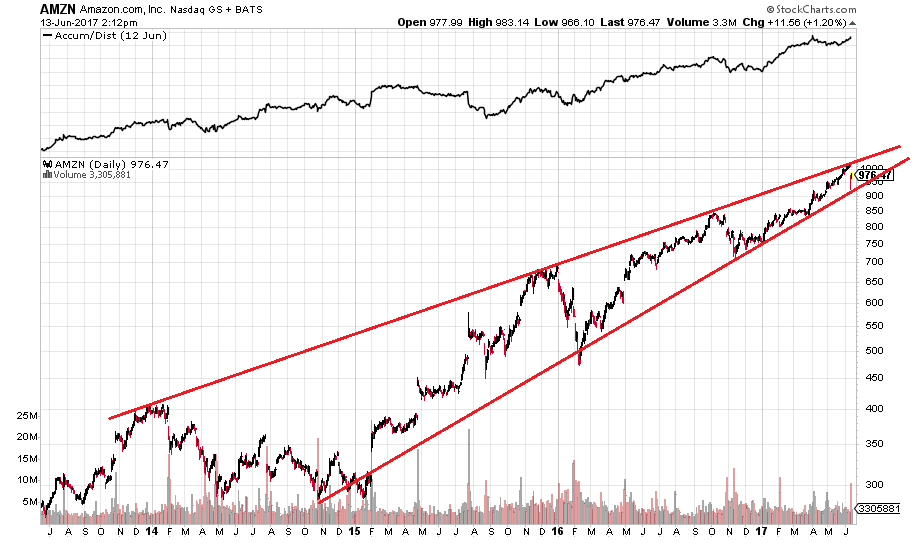

And the leader of the gang:

Amazon’s (AMZN) wedge is the most pressuring with a break imminent. Does all this mean the FANG move is near an end? No, because ascending wedges do break to the upside as well. A case in point is Nvidia (NVDA):

Leave A Comment