In a world in which everything is up if only one excludes all the things that are down, a favorite pastime of “strategists” has become announcing how high S&P500 earnings would be if only one excluded energy companies… and the impact of the dollar… and China’s economic slowdown… and the Emerging Markets currency crisis… and the [cold|hot|just right] weather… and rising labor costs… and everything else that stands between revenue (non-GAAP of course, just ask Tesla) and the bottom line.

What if one does the inverse: what if instead of eliminating the worst performing sectors (and all other factors that detract from performance in a priced to centrally-planned perfection world) one eliminates the biggest company in the world, Apple?

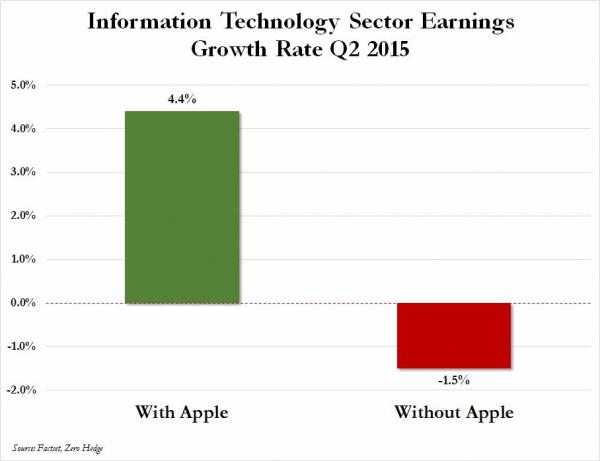

The result is troubling. As can be seen in the chart below, when it comes to second quarter earnings, Apple made all the difference in the world, literally, between gains and losses for what was otherwise one of the “best” performing sectors. In fact, AAPL provided a whopping 6% swing in IT sector EPS for Q2, pushing them from down 1.5% Y/Y without AAPL to +4.4% with AAPL.

Q2 is now in the past, with everyone focused on Q3. What can one expect here?

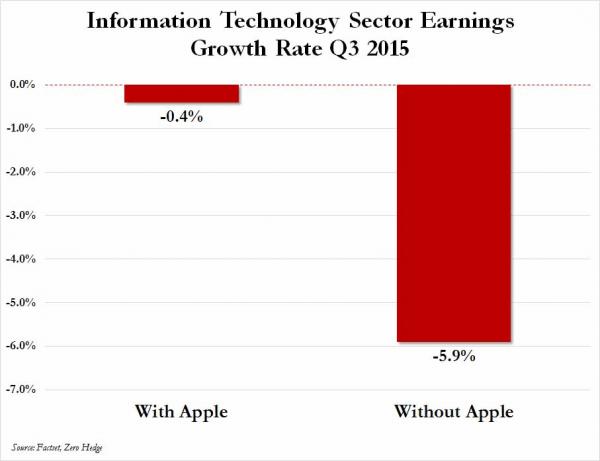

According to Factset “Apple is currently expected to be the largest positive contributor to year-over-year earnings for the Information Technology sector for Q3 2015.” The bad news, however, is that for the first time in over two years, without and with the contribution of AAPL, the IT sector will post a year over year decline in EPS, the first Y/Y drop since Q2 2013 when it was AAPL that dragged infotech EPS lower. As for earnings excluding AAPL, forget it: “the estimated earnings decline for the Information Technology sector is -0.4%. Excluding Apple, the sector would report a year-over-year decline in earnings of -5.9%.”

As Factset further adds, it really is all about AAPL: “As of today, if Apple reported actual EPS equal to or above the mean EPS estimate, it would mark the 5th consecutive quarter that Apple has been the largest contributor to year-over-year earnings for the Information Technology sector.“

Leave A Comment