You are probably aware that the U.S. markets are off to their worst start in recorded history. However many media commentators are bear market deniers and believe that there isn’t a bear market at all and stocks will go up forever. If there is a correction, deniers believe that the Fed will just restart their quantitative easing programs and stocks will continue their ascent to infinity.

I’m sorry to tell you that if you look at the data, the global financial markets are already in a deep bear market and their central banks have been ineffective in printing themselves out of recession. The U.S. is being pulled down by international forces beyond our control and our economy is likely headed for recession in 2016. Let’s take a quick look around to see the carnage.

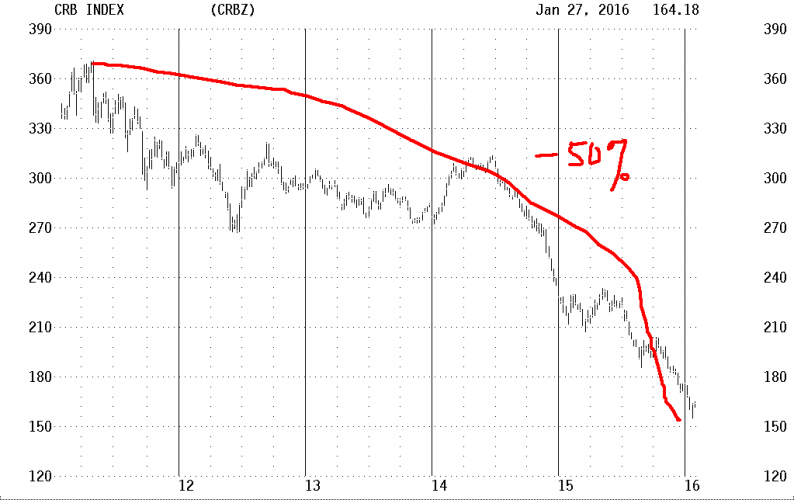

First there are commodities which have been in a massive bear market since 2011. The oil collapse just pushed it down further as the CRB commodity index is down over 50% since 2011 and is showing no signs of picking up.

International markets all in bear market territory

Next we move to the international markets. First up is our favorite brother, the United Kingdom, which topped out in the spring of 2015.

Next we move to the biggest country in the Euro zone, Germany.

The European markets have declined 20%+ since the start of their latest round of quantitative easing that is printing over 60 billion euros per month. This is not a good sign.

Next we move to the Far East. China is down over 40% and even the Kamikaze Japanese are off over 20%. The Bank of Japan is buying over 80 trillion yen in assets (including stocks) per year.

U.S. being held up by mega-caps

The U.S. major market indices like the S&P 500 and Dow Jones Industrial Average aren’t in bear market territory yet because they are being held up by the defensive shift into megacap names like Google (GOOGL), General Electric(GE), Amazon (AMZN) and Facebook (FB). If you look under the hood of the US markets, the small caps are well into bear market territory and midcaps are close behind.

Leave A Comment