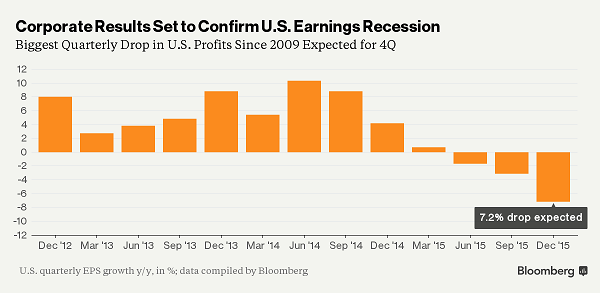

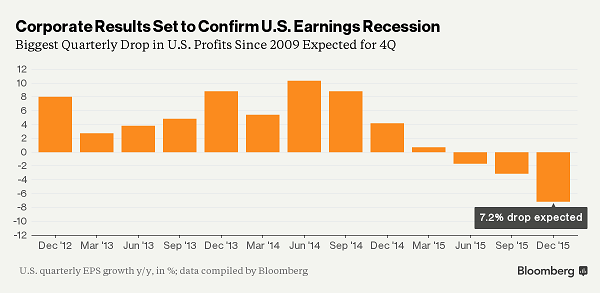

Are corporations in great shape? Three consecutive quarters of declines in earnings suggest that they are not. Worse yet, record high leverage coupled with close-to-record low interest coverage indicate stress within corporate balance sheets.

Beginning with the “profit recession,” it has become fashionable to describe the deterioration as a function of the price collapse in oil and gas. However, that assessment fails the sniff test on three different levels. One, six of the ten S&P 500 economic segments share in the year-over-year earnings contraction, not the energy sector alone. Second, if one excludes energy as an outlier on the negative side, one would be obliged to throw away super-sized contributors like health care on the positive side of the ledger. In doing so, the profit picture still appears weak.

A third reason that it is foolish to dismiss energy earnings? Analysts made the same mistakes prior to the economic downturns in 2001 and 2008. It was short-sighted to toss the technology sector in the dot-com collapse. It was irrational to exclude financials in the banking crisis. It follows that it would be just as insular to ignore the influential energy segment when evaluating corporate profitability today.

Perhaps more troubling is the erroneous belief that corporations have improved their balance sheets since the Great Recession. In truth, U.S. companies have doubled their total debt levels since 2007, while simultaneously finding it more difficult to pay interest expenses on outstanding obligations.

According to Investopedia, the interest coverage ratio determines the ease or difficulty by which a company can service its existing debt. The ratio is calculated by dividing a company’s earnings before interest and taxes (EBITA) by the company’s interest expenses for the same period. The higher the ratio, the less burdened by borrowing costs a company is; the lower the ratio, the more onerous the debt expense is for a company.

Leave A Comment