Let’s start with where we left off last weekend:

“Currently, we do not know whether the current corrective action is JUST a normal, healthy correction, or the beginning of something bigger.

BUT – this is the expected correction we have been discussing over the last several weeks. It is also something we had planned for by reducing overweight positions and adding a short-hedge to portfolios.

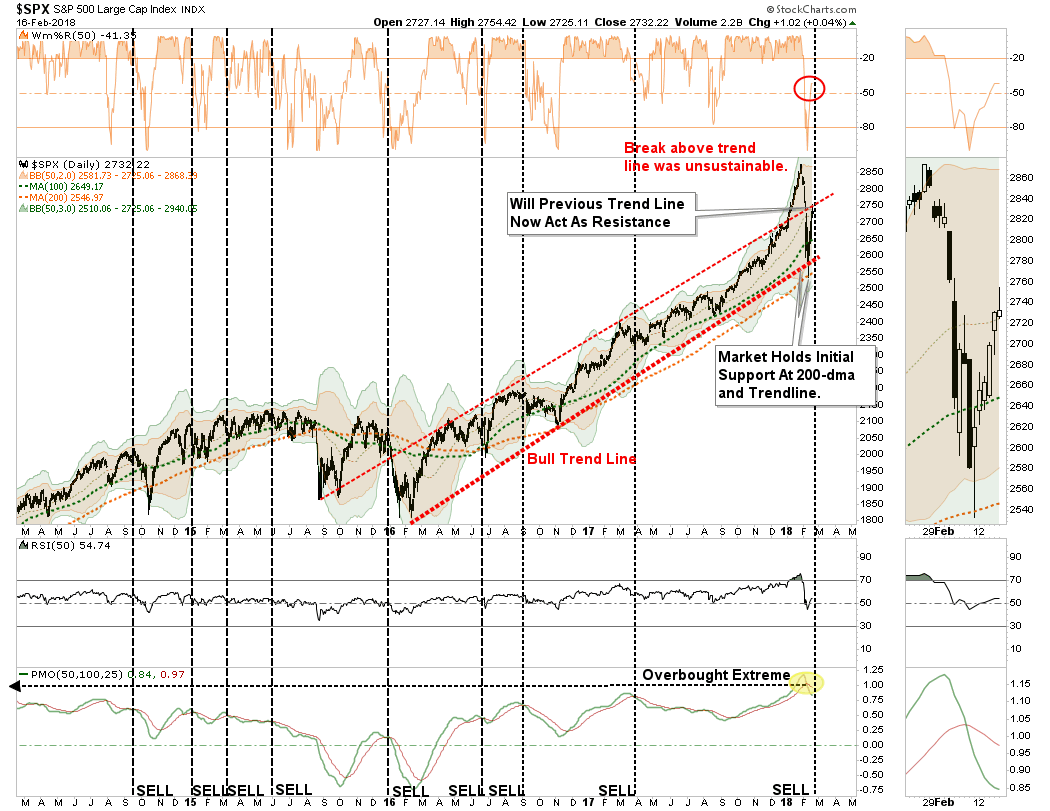

With the markets on a short-term sell signal (noted by black vertical dashed lines in the chart above,) the current correctional process is underway. But, with the market now oversold on a VERY short-term basis a counter-trend rally over the next week, or two, should be expected.”

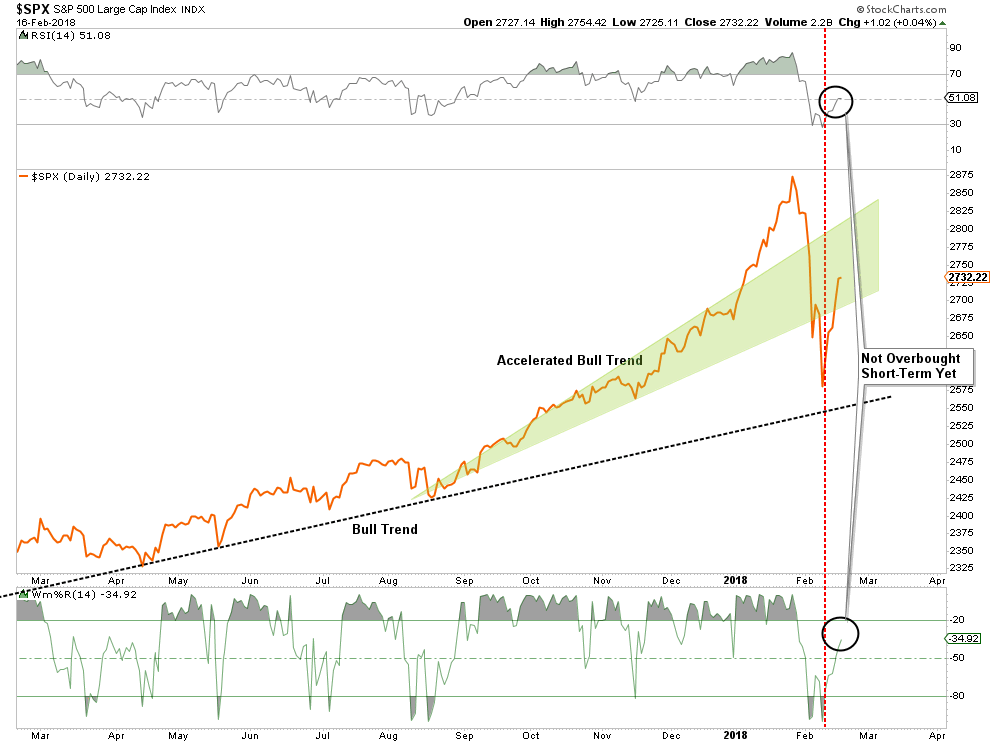

Well, we did indeed get a very nice rally last week with the market breaking above the 50-dma on Thursday.

While the immediate consensus is the “bear market of 2018” is now over, there are several important points about the chart above that should be considered.

The bottom line is that while there was much “angst” in the markets last week, the market has not violated any important trend lines that would suggest the current sell-off is anything more than just an ordinary “garden variety” correction.

But, I wrote:

“The larger concern currently, is the ‘sell signal’ which has been triggered at abnormally high levels and remains in extremely overbought territory. Such suggests there remains ‘fuel’ for either a ‘deeper correction’ or a ‘consolidation’ of the markets in the weeks ahead to ‘work off’ that ‘overbought’ condition. Historically, markets don’t resolve such conditions by trading ‘sideways.’”

While we are watching that closely, it certainly doesn’t mean the market can’t rally higher from here. In fact, with the markets clearing the 50-dma on Friday, the upper-trend line and old highs are currently the only real resistance.With markets not yet back to “overbought” conditions, it is certainly possible for the market to rally further next week.

The greenish triangle shows the path of the accelerated bullish trend that began last August which currently remains the most likely path for now.

While the “Great Bear Market Of 2018” may indeed be behind us, it did NOT resolve the longer-term overbought, overvalued and overbullish conditions for investors.

The Real Bear Is Still Coming

The good news, for those who remain ever bullishly inclined, is on a long-term, monthly basis, the bull market remains intact for now.

Unfortunately, despite the rather harrowing correction, little was done to relieve any of the underlying pressures.

These are not signs of a real, lasting bottom, which long-term investors should aggressively buy into.

Leave A Comment