It’s been more than seven years since the financial crisis and Central Banks globally have kept their rates at record lows, and have even ventured into negative rate territory, to stave off the threat of a recessionary relapse and boost anemic economic growth. While such policies have failed to spark inflationary pressures or boost economic growth,the “illusion of permanent liquidity” has spurred investors to make risky bets and push up asset prices.

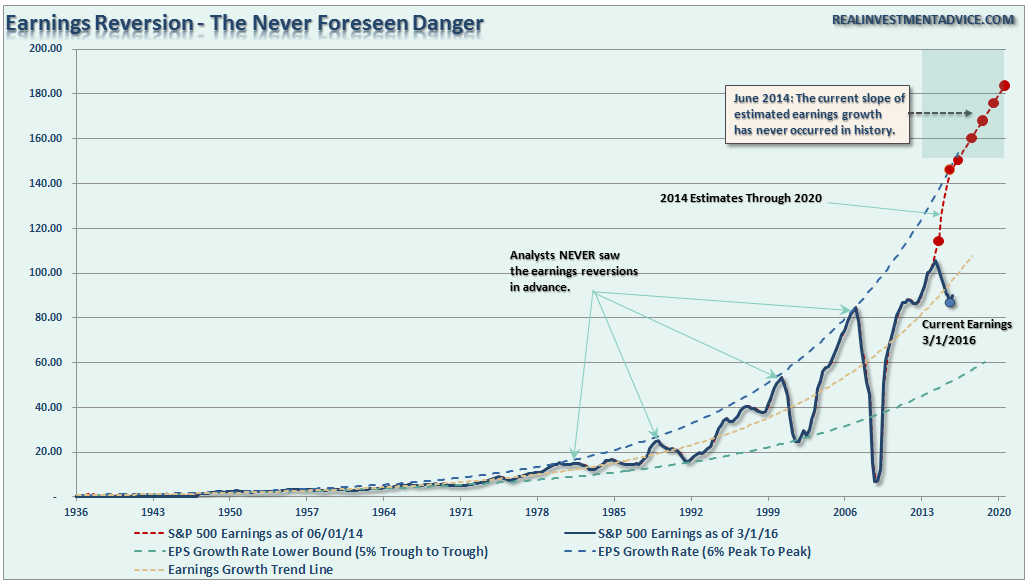

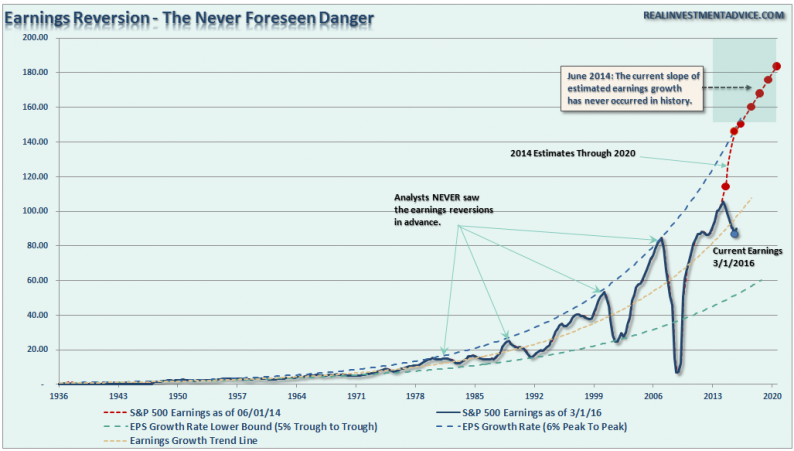

This “illusion” has not only been driving investors to make risky bets across the entire spectrum of asset classes; it has also led to the illusion of economic stability and growth. For example, in 2014, financial analysts started pushing the idea of a “new generational cycle” of growing earnings driven by a stronger economic growth that would last for another decade.Unfortunately, as we are now witnessing, such rosy projections have fallen far short of reality.

Even the Federal Reserve’s own forecasts have fallen well short of reality. As I discussed previously:

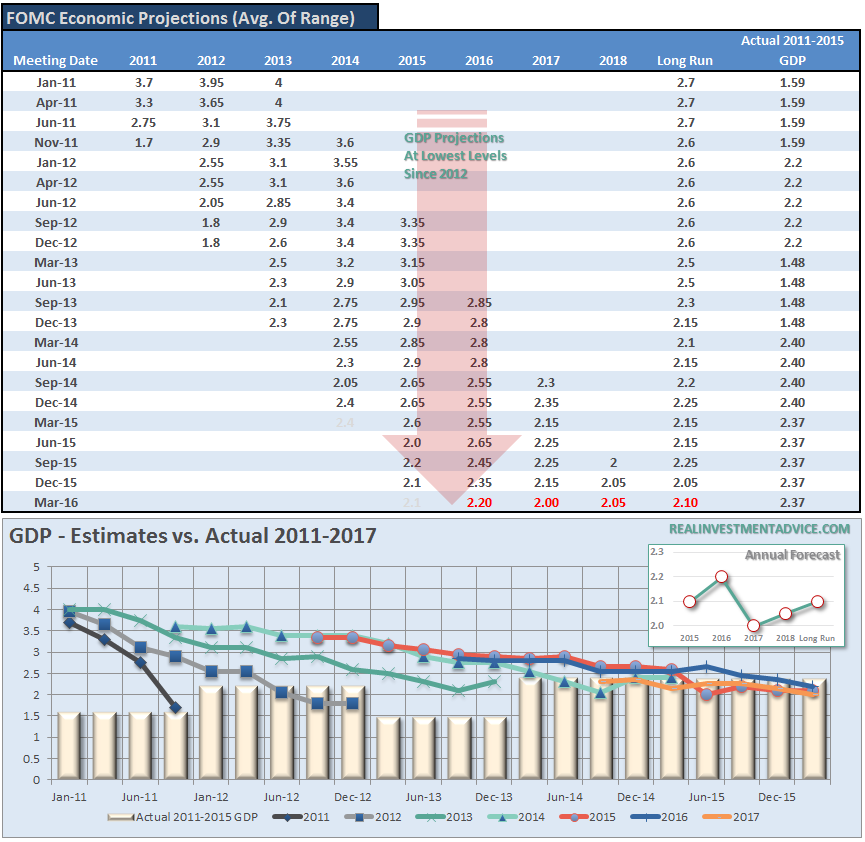

“As shown in the chart below, once again the Fed lowered expectations further for economic growth and reduced the number of rate hikes this year from 4 to 2. Yep, ‘accommodative policy’ is here to stay for a while longer which lifted stocks yesterday’s close.”

“Besides being absolutely the worst economic forecasters on the planet, the Fed’s real problem is contained within the table and chart above. Despite the rhetoric of stronger employment and economic growth – plunging imports and exports, falling corporate profits, collapsing manufacturing and falling wages all suggest the economy is in no shape to withstand tighter monetary policy at this juncture.”

While Central Banks globally are working to “repeal” the economic cycle, the continued deterioration in economic growth has become more prevalent as even ongoing accounting manipulations, share buybacks, and cost cutting are no longer boosting bottom-line earnings.

Leave A Comment