The Q1 earnings season unofficially starts today with Alcoa reporting after closing bell and some of the biggest banks in the U.S. reporting later in the week. Analysts expect the S&P 500 to post the third quarterly earnings decline, but things should get better from here on out, believe strategists at Bank of America Merrill Lynch.

Earnings recession continues in Q1

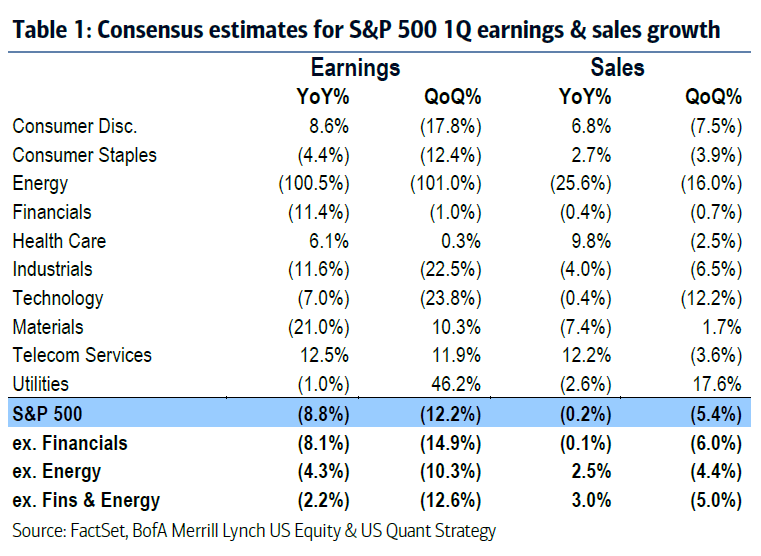

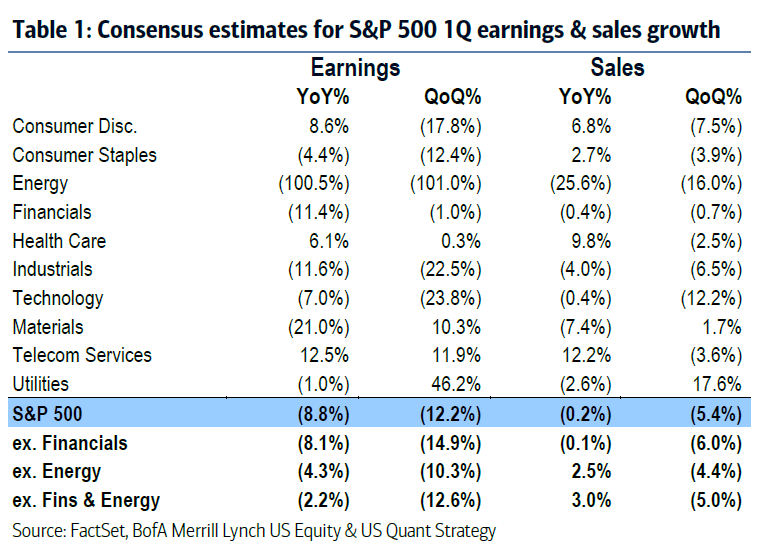

Savita Subramanian and her team report that analysts are predicting a 9% decline for Q1 earnings, although last week S&P Capital IQ pegged the expected decline at 8%.

Subramanian believes the first quarter will mark the trough in earnings as many of the biggest macro headwinds wind down throughout the year.

She notes that oil prices declined 47% year over year on average over the previous four quarters. Also the trade-weighted U.S. dollar declined by an average of 16% year over year. In the first quarter of this year, oil prices plunged by an average of 34% year over year, while the U.S. dollar climbed by only 4% on average. The Energy sector continues to be a problem for the S&P 500, although even without the sector, the BAML team said analysts are predicting a 4% decline for Q1 earnings. They add that revenue growth will likely remain flat year over year or climb 3% excluding Energy, although this is still an improvement from the fourth quarter’s 3% decline or 1% gain excluding Energy.

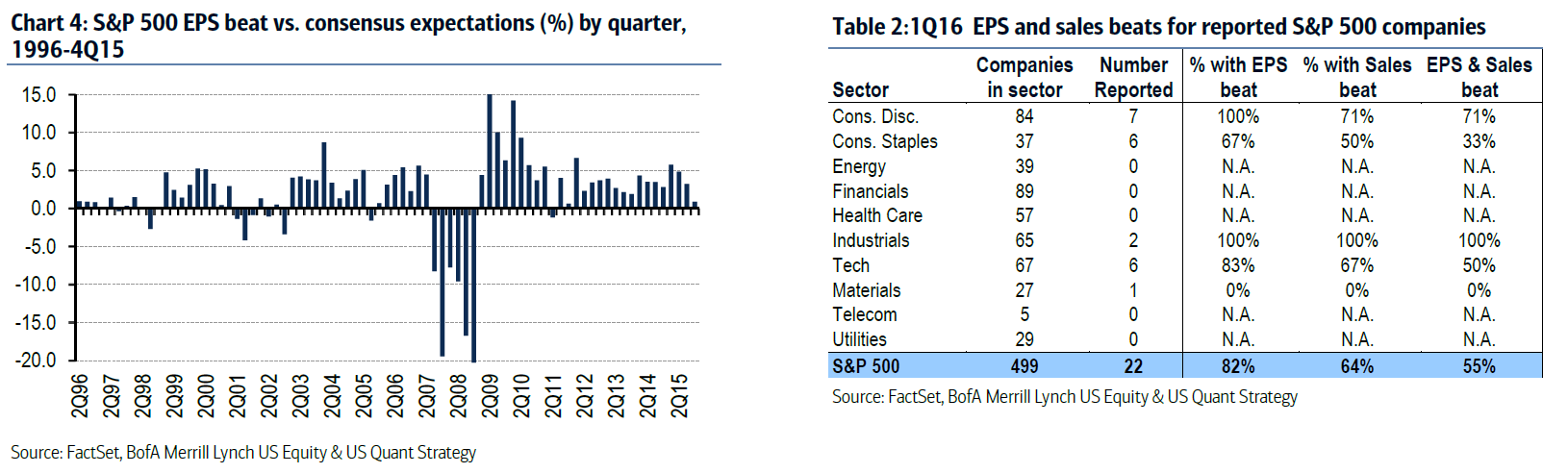

Q1 earnings beat may already be priced in

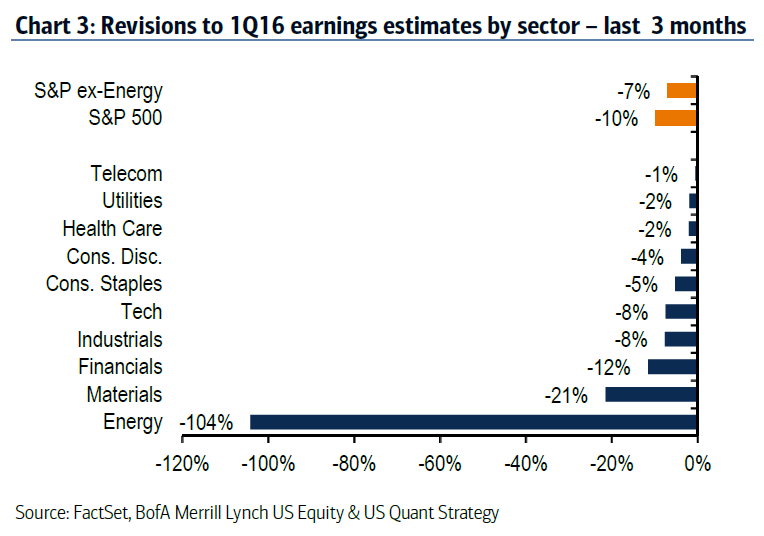

They note that since the beginning of the year, consensus estimates for Q1 earnings have been slashed 9%, which is more than twice the usual 4% cut seen in the pre-season.

They add that this is the “most extreme three-month cut” since the first quarter of 2009.

Of course Energy accounts for the biggest chunk of that as analysts are now expecting profit growth to be in the negative. The Financials sector is also expected to weigh on the results as “lower-for-longer rates and a tough capital markets backdrop” have impacting the sector.

Leave A Comment