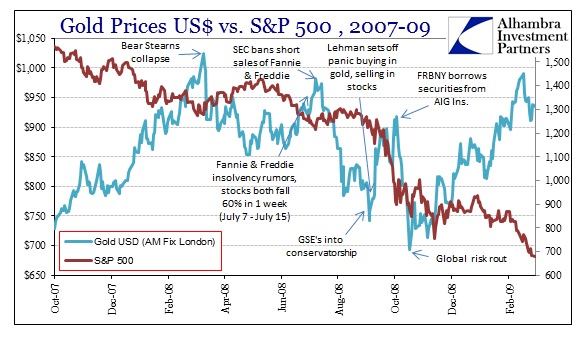

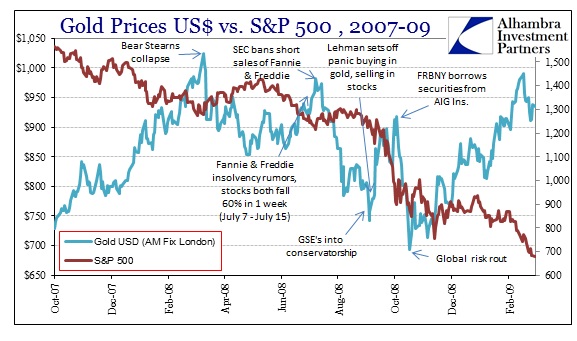

The duality of gold in the modern wholesale fabric has perhaps been on display this year more so than at any time since 2008. That year, the year of the euro/dollar-drawn panic, gold was seemingly more volatile than any other asset – if only for its virtuous tendency to as sharply rebound for every major crash. And in 2008 there were three, with gold staging higher and soundly beating most asset classes through the whole of the event.

The two opposing forces are not set in match by some traditional sense of central bank “money printing” so much as the modern view of central bank absurdity. On the positive side, gold is the safe haven that is believed to survive any and all central bank miscalibrations and the inevitable total breakdowns in the theories that set them. On the negative side, there is that contemporary, ephemeral wholesale “dollar” which, for gold, sets within the catalog of interbank collateral and thus, in leasing and swaps, as pushing down against price.

In 2008, that was the gyrations of gold as each side jockeyed for marginal supremacy. Gold was uniquely surging all the way until Bear Stearns failed; from there, it sharply and severely declined until the very day the Fed finally expanded the collateral eligibility for its ad hoc, afterthought wholesale experiments. And so it would repeat, with the “dollar” taking turns with safety to produce the golden roller coaster.

I think we are seeing the same again, and in many ways it may be providing the same mixed signals to those not versed in these wholesale, euro/dollar ways. Whenever gold is so sold, convention declares an end to all investment and risk concerns as if everything suddenly has been fixed. That was the great case made back in 2013 when gold crashed, but that, too, was far more about the overwhelming “dollar” disruption than any sort of purely positive view of the world.

Lately, October 15 has been showing up all over the money markets. So it is with gold, hitting its most recent high of $1,183.35 (morning fix) smack upon October 15; it has been downhill since. My sense is that the decline served as an “all-clear” for other asset classes to take the reprieve the Chinese Golden Week had provided to further bid, bid, bid.

Leave A Comment