Over the last two decades, China has been following the Gerschenkron Growth Model to deliver high levels of extended economic growth.

The Gerschenkron model of growth goes like this:

China is now at this last step.

China has to rebalance its economy. It needs to transition from an investment and export led economy to a consumption based one; retransfer wealth from the vested interests in local government and private businesses back to households. In addition, it needs to deleverage by paying down, writing off, or inflating away its debt stock.

The quickest way to resolve a debt problem like this and rebalance an economy is to go through a financial crisis where assets are sold and debt written down. This is what the US did in the 1930s. But China can’t go this route because this path involves high levels of unemployment that bear socio-political risks, which the CCP can’t afford.

A much more likely scenario (which I believe we’re beginning to see now) is one where the CCP takes a gradual and pragmatic approach.

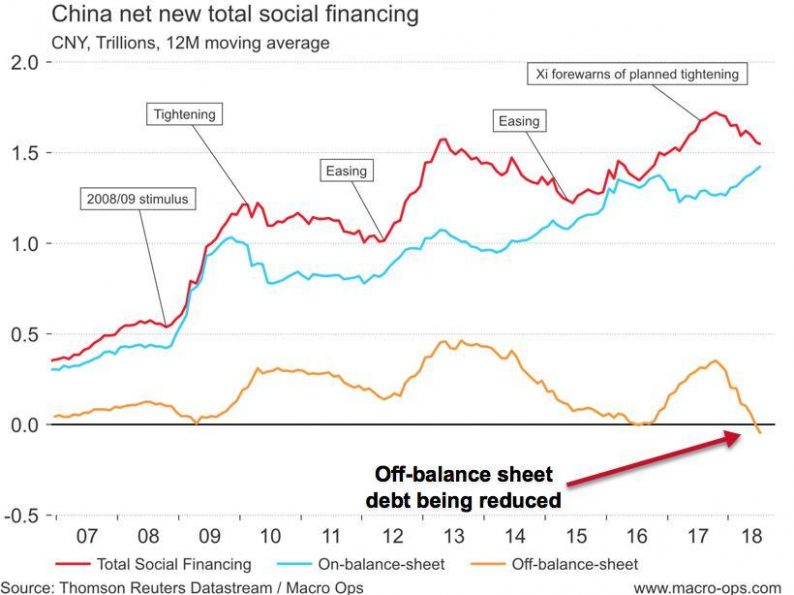

They assign the debt servicing costs to local governments, who are then forced to sell assets in an orderly manner to pay down debt. And then the CCP goes after debt in the most vulnerable areas of the economy, primarily the off-balance sheet/shadow banking sector and P2P lending, while balancing this with leveraging in the visible areas parts of the economy (ie, local government issuing bonds to boost specific investment).

This approach means that we shouldn’t expect a hard landing or financial crisis. It’s likely to look much more like Japan’s lost decade, though China has made it very clear in recent months that they won’t make the same mistake the Japanese did and let their currency strengthen too much. So we should expect the yuan to continue slowly devalue against the dollar.

Leave A Comment