1. Market Update

During the last three weeks gold broke out to the upside and posted a sharp rally until $1,303 missing the January 2015 high only marginally. Since then prices have come back down to $1,257 retracing all of the previous gains. Overall the bulls remain in control and gold could still rally towards $1,333 – 1,355 before the first wave up is finally finished. In a new bull market gold will stay overbought much longer than anyone can imagine. But sooner or later the laws of gravitation and regression will force the corrective second wave down. Since gold is acting strong but making no progress overall since February it is very likely that we won’t see prices below $1,180 anymore. In fact I see $1,180 – $1,215 as the zone where a pullback/dip should already end. This means the important 200MA ($1,156) will need quite some more time before it can act as massive support in this zone.

The gold- and silver-miners had a spectacular start into 2016. Some of them exploded more than 300% and 400% after being beaten down for nearly five years. Although it might be tempting to chase this sector the reality will bring us a pullback sooner or later. This dip will offer a great opportunity cause this sector has a long way to go up. I will present the first mining recommendation today and plan to add more during the next couple of months.

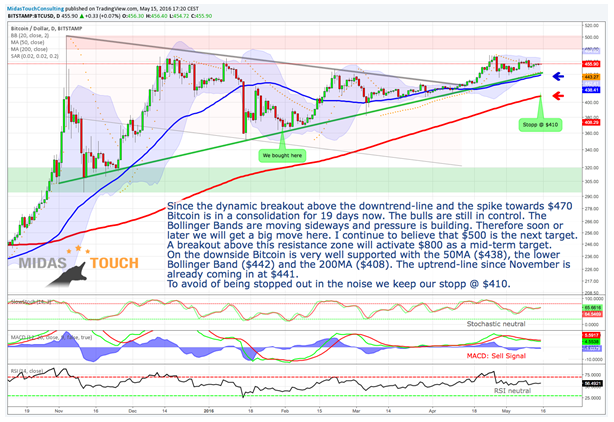

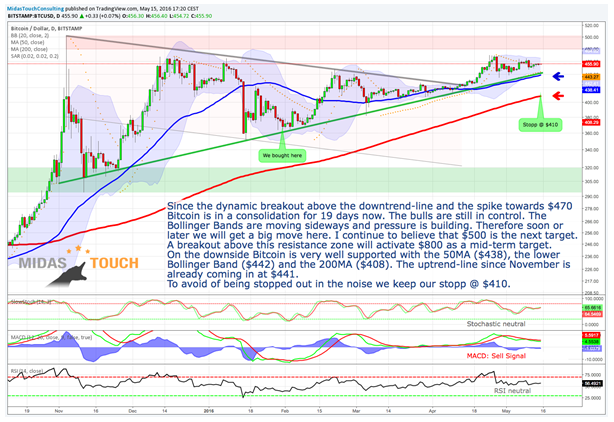

Despite many discussions about Bitcoin, the cryptocurrency is holding up very well and is consolidating the breakout above the downtrend-line for nearly three weeks now. I continue to think that the uptrend will push Bitcoin towards $480-$500 in the next one or two months.

Now that “sell in may” has arrived and the US-Dollar is recovering as expected there is no need to chase any market. Instead let´s be patient and wait for the inevitable pullback in gold, silver and the miners.

2. Bitcoin – in a consolidation but $500 is very likely

Since the dynamic breakout above the downtrend-line and the spike towards $470 Bitcoin is in a consolidation for 19 days now. The bulls are still in control. The Bollinger Bands are moving sideways and pressure is building. Therefore soon or later we will get a big move here. I continue to believe that $500 is the next target. A breakout above this resistance zone will activate $800 as a mid-term target.

On the downside Bitcoin is very well supported with the 50MA ($438), the lower Bollinger Band ($442) and the 200MA ($408).The uptrend-line since November is already coming in at $441.To avoid of being stopped out in the noise we keep our stopp @ $410.

Leave A Comment