The short-term uptrend continues despite today’s weakness into the close.

I am looking for signs that the next short-term downtrend is starting. The first step in a new downtrend is for the SPXEW to close below the 5-day average. We don’t have that yet, but it looks close. And the momentum indicators are near the top of the range.

I am also looking for signs of a peak in the medium-term trend. The weakness in this semiconductor index is not a good sign for stocks medium-term. If this heads lower, the market is likely to follow lower too.

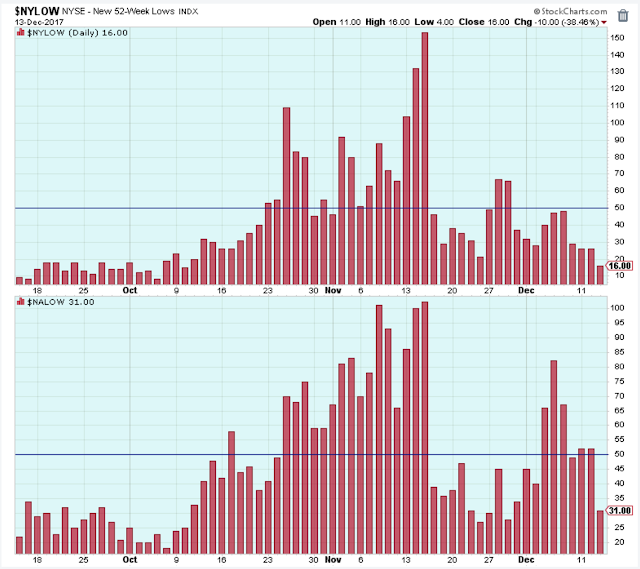

Even though stocks look extended and ready for a break, so far there doesn’t look like much broad market selling is taking place based on the chart below. There are too few new 52-week lows to be worried about a significant sell off.

Outlook Summary:

In the short-term, the best period for buying stocks has past. I am watching for signs of a new downtrend for both the short-term and medium-term trends.

The long-term outlook is mixed.

The medium-term trend is up.

The short-term trend is up.

Leave A Comment