In a meeting last year, an experienced investment advisor explained to me what he looks for in an “alternative” strategy:

“Low correlation, low volatility, no downside, and high returns. I want to have my cake and eat it too.”

That is a verbatim quote. The advisor went on to tell me story after story on how he was “burned” by various alternative investments, none of which measured up to his lofty expectations.

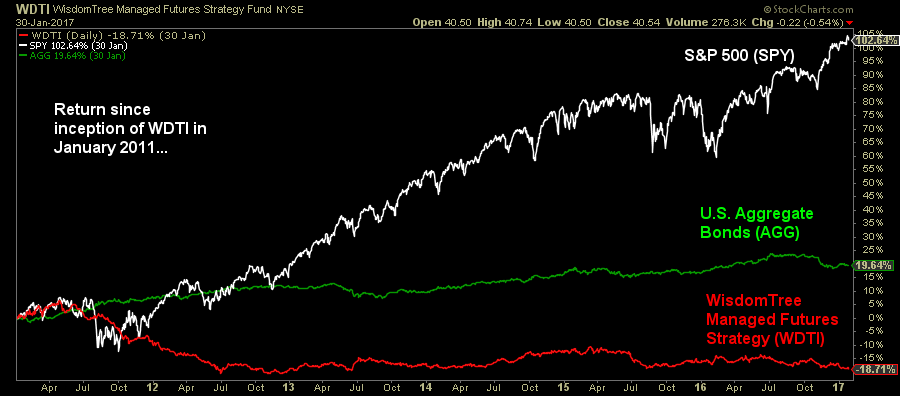

One such story featured the first managed futures ETF, launched in January 2011. Following the crash in 2008, managed futures were all the rage. They performed extremely well in the crisis (Barclays CTA Index up 14% in 2008) and investors did what they do best: fight the last war by chasing past returns. A quick description of the product which currently has over $200 million in assets:

“The WisdomTree Managed Futures Strategy (ticker: WDTI) seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad market equity or fixed income returns.”

“Positive total returns”

“Rising or falling markets”

“Not directly correlated”

What’s not to like?

Six years later, WDTI is down 19% versus a gain of 103% for the S&P 500 (SPY) and 20% for U.S. Bonds (AGG). Needless to say, the aforementioned advisor is no longer invested, bailing out in late 2012 after a 20% drawdown. Where did the money go? Into the next hot alternative product, and then the next, and then the next.

Each time, the blame was laid squarely on the investment product/manager and not the unrealistic expectations of the investor:

“They all sound great on paper and then do nothing but lose money or provide no return. I can do that myself. Am I right?”

Perhaps, but by doing it himself there would be no one to blame but himself, a far more tenuous position. Much easier to outsource the blame and show that you are taking action by “cutting your losses” and always investing in the next hot product. How could anyone fault you for doing that?

Leave A Comment