The Priceline Group, based in Norwalk, Connecticut, is the provider of online travel, restaurant reservations and other related services. They operate throughout the world in over 200 countries, and they have saved customers over $10 billion since they launched. The group’s main brands include Priceline.com, Booking.com, Kayak, agoda.com, rentalcars.com and OpenTable. Falling 17% in January, Priceline was downgraded by analysts. Both Goldman Sachs and Raymond James downgraded the stock, citing that competition from Airbnb would be a major threat to the online booking business. Goldman analyst further believed that online travel agents have already reached a peak in market penetration, and hotels will be less willing to continue to give online service providers better rates.

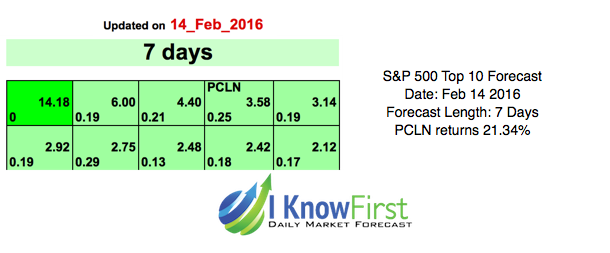

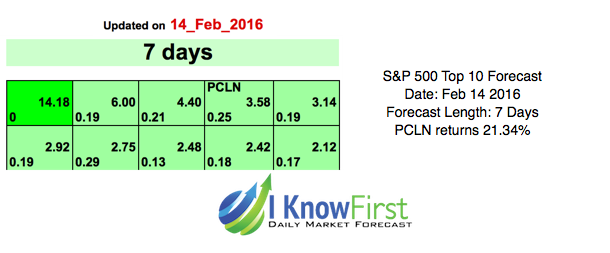

Nevertheless, this past week the company added over $13 billion to its market capitalization as its shares soared from an adjusted closing price of $1,058.01 on Friday, February 12th, to $1,238.28 on Friday, February 9th. This period marked Priceline’s biggest consecutive session price gain since it gained $307.50 over the six sessions ending May 3, 1999. On February 14th, I Know First had a strong signal for Priceline in the S&P 500 top 10 picks forecast.

Priceline’s huge gain in price can be mainly attributed to the earnings report that they released on February 17th, where the company outperformed analyst expectations and strongly outperformed their competitors in the online travel agent space. The company also put forward a very strong forward guidance, causing the stock to gain $124.88, or 11.3% on Wednesday, making it the first member of the S&P 500 to gain $100 in a single session.

For the fourth quarter, The Priceline Group announced gross travel bookings of $12.0 billion dollars, adjusted for currencies this translates to a 13% increase over the last year. Priceline’s gross profit for the fourth quarter was $1.9 billion, adjusted for currencies; this means the group experienced a 12% increase from the prior year. The company reported earnings per share of $12.63, well above the analysts’ average estimate of $11.80.

Leave A Comment