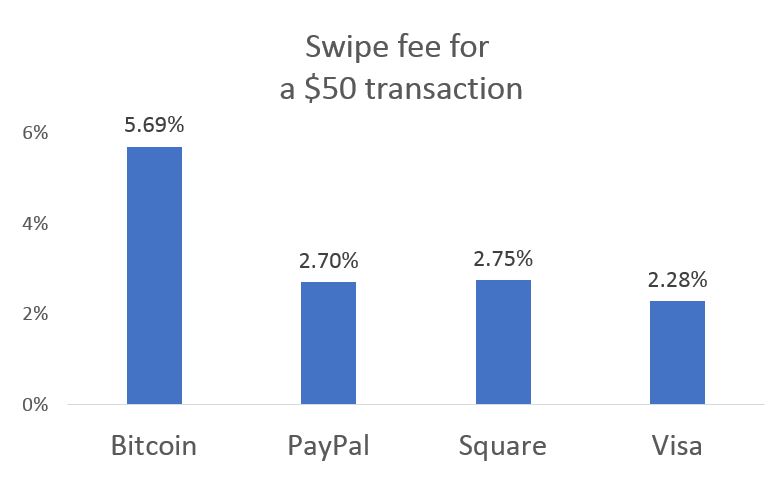

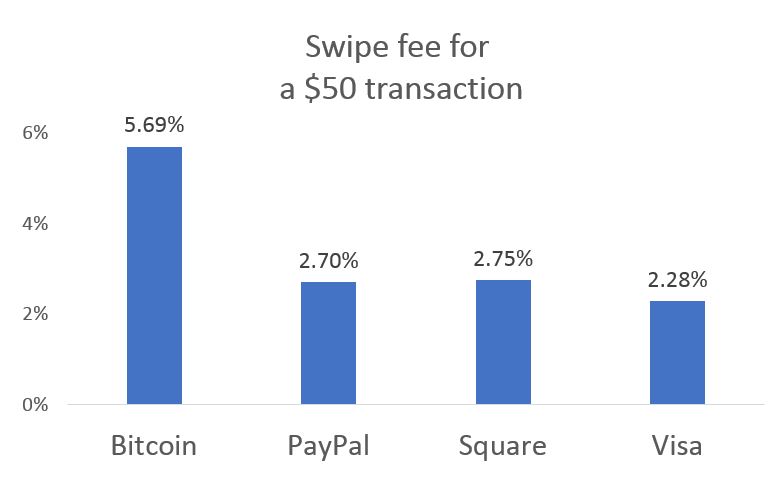

You could buy a Domino’s pizza with bitcoin if you wanted to. A large pepperoni pizza will cost about $13. The cost to process the transaction with bitcoins will add about 88% to the price.

That’s right. You must pay to use bitcoins. This isn’t unusual. You also pay to use a credit card, PayPal or Square devices at the checkout counter. The difference is that the fees for the cryptocurrency are steep.

Transaction fees vary. Some payment processors charge less. With credit cards, fees are different for online purchases or when the merchant keys in the card number. But, credit card fees are always small.

On the other hand, the fees for bitcoin for everyday transactions are prohibitive.

Fees are high because transferring ownership of coins is expensive. Bitcoin is a digital currency. It exists only online.

Transferring coins involves the blockchain, a futuristic technology that’s here today. This technology uses large amounts of electricity. It requires expensive hardware. Consumers must pay those costs.

The Future of Bitcoin

These high transaction fees don’t mean the cryptocurrency isn’t useful. Some merchants accept it to benefit from an image of high tech. Others accept it because it’s an excellent way to avoid scrutiny.

Bitcoin transactions can be anonymous. This makes the currency ideal for purchasing marijuana in states where it’s illegal. Where marijuana is legal, stores can’t accept credit cards, so the digital currency is more convenient than cash.

For any illegal transaction, bitcoin might be your best choice. For law-abiding citizens, the cryptocurrency is for speculation and it’s unlikely to ever be money.

With that in mind, speculation in bitcoin can be profitable. But, digital currencies aren’t changing the way you shop.

Leave A Comment