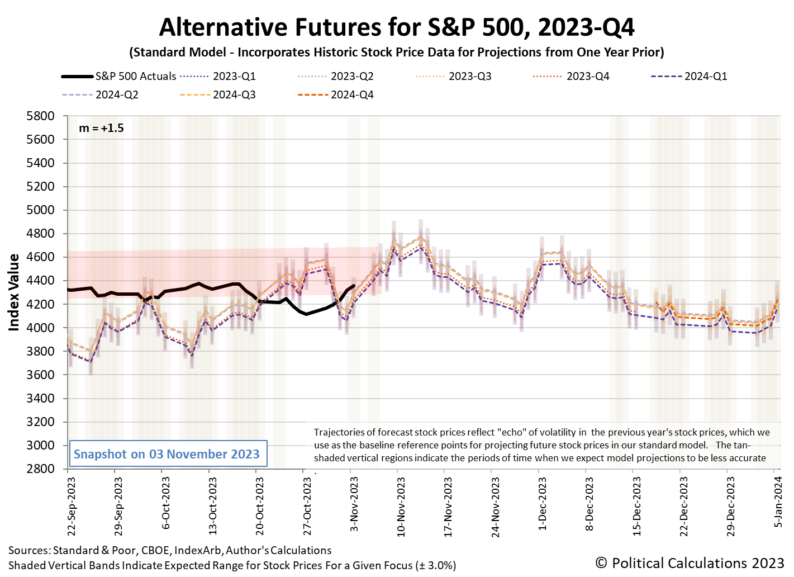

It was just a week ago that we were looking at the serious prospect of a change in market regime for the S&P 500 (Index: SPX). But now, we have strong evidence the market regime that’s been in place since 9 March 2023 has reestablished itself. Because it has, the index rose 5.85% over the past week, closing out Friday, 3 November 2023 at 4358.34.That increase points to a signficant role for the U.S. Treasury yield curve in determining the market regime for the U.S. stock market. Last week’s developments came as the Federal Reserve, which has strong control over short-term interest rates, chose to leave them alone. The Fed however has little control over long-term interest rates, which are set by the market.Up through 19 October 2023, those rates had been headed higher and were moving toward “reverting”, which is to say that long-term rates were increasing to where they would soon rise higher than the short-term rates controlled by the Fed. Since 19 October 2023 however, longer-term rates have fallen, with the U.S. Treasury yield curve becoming more inverted again as a result.These changes affect publicly-traded companies that borrow to support their long-term growth plans. Rising long-term rates would mean higher costs to borrow over the lifespan of their investments in their businesses, but falling long-term rates mean they will have lower costs. The first scenario was accompanied by falling stock prices, while the second has been accompanied by rising stock prices. These companies have better prospects for investors in the second scenario.Stock prices have risen enough in response to the shifting of the long-term portion of the U.S. Treasury yield curve that the recent decline now looks fully like an outlier event with respect to the redzone forecast range in the latest update for the alternative futures chart. latest updateThe past several weeks have provided the basis of a natural experiment, one that’s given us the best look we’ve ever had at what can cause a change in market regime. Right now, with no change in market regime, the multiplier for the dividend futures-based model looks like it will continue unchanged with m = +1.5.Meanwhile, for additional context behind what may be influencing the direction of the longer-term portion of the yield curve, here is our summary of the other market moving events of the week that was. Monday, 30 October 2023

- Oil falls more than 3% as concerns about Mideast supply ease

- China’s property foreclosures up by a third so far in 2023

- China’s Oct factory activity likely rose as economy finds footing: Reuters poll

- German economy shrinks slightly in Q3

- German inflation eases in October to lowest level in two years

- ECB hawks take aim at rate cut bets for first half of 2024

- ECB keeping up pressure on banks to loosen ties with Russia -Enria

Tuesday, 31 October 2023

- Benchmark 10-year Treasury yield could top 7%: Ned Davis Research

- Wages boost US labor costs, house price inflation picks up

- US annual home price growth accelerates again in August

- Fed’s reverse repo facility drawdown looms large in balance sheet debate

- China factory activity unexpectedly shrinks in Oct, dents recovery momentum

- Some Chinese institutions borrow at 50% rate as liquidity squeezed

- Canada’s economy stalls in August, seen slipping into recession in Q3

- Canadian factory sector downturn extends to longest since 2016

-

BOJ modifies bond yield control, re-defines long-term rate cap

- BOJ relaxes grip on rates as end to yield control looms

- Japan on standby to deal with ‘one-sided’ yen moves – top FX diplomat

-

Euro zone inflation and growth fall as ECB hikes bite

- Italy’s economy stagnates in Q3, but inflation slows sharply

- French GDP growth slows, inflation eases

- German retail sales fall unexpectedly in September

- ECB’s Nagel says inflation has not been defeated yet

- ECB’s Villeroy: France has clearly passed inflation peak – statement

Wednesday, 1 November 2023

- Oil falls to settle at 3-week low as Fed policy stance lifts dollar

- U.S. manufacturing sector slumps in October-ISM

- Fed poised to hold rates steady despite economy’s bullish tone

-

Fed keeps rates unchanged, Powell hedges on possible end of tightening campaign

- Fed’s Powell says higher rates need to persist to affect Fed policy choices

- Fed’s Powell says balance sheet rundown will proceed without change for now

- BOJ intervenes as JGB yields make decade highs after YCC tweak

- Weak yen, inflation overshoot may prod BOJ to phase out stimulus by year-end: ex-BOJ official

- ECB reviews interest on government deposits to curb losses -sources

Thursday, 2 November 2023

- US factory orders surge in September

- US holiday sales growth to slow as inflation pinches wallets – report

- Analysis-Fed meeting revives Treasury bulls after brutal selloff

- Bank of England set to keep rates at 15-year high despite slowdown signs

- Hong Kong central bank leaves interest rate unchanged, tracking Fed move

- Norway keeps interest rates on hold, eyes December hike

- Brazil cenbank cuts rates, with more likely to come, but flags ‘adverse’ backdrop

- Japan’s GDP likely shrank in Q3 as China slowdown hits exports: Reuters poll

- Exclusive-BOJ plans to exit from easy policy next year but needs some good fortune

-

BOJ risks being behind the curve on inflation: ex-central bank economist

- Japan compiles $113-billion package to cushion inflation

- Euro zone factory downturn deepened in October -PMI

- German unemployment rises more than expected in October

- ECB interest rates are at good ‘cruising altitude’, ECB’s Knot says

- ECB sees no consumption boom as rich have most of the savings

- ECB’s Lane sees good case for ‘soft landing’ of economy

- S&P notches best day since April, Dow since June; Nasdaq posts five-day win streak

Friday, 3 November 2023

-

US job growth slows in October; unemployment rate rises to 3.9%

- Instant View: US jobs growth slows more than expected in October

- US service sector at five-month low in October- ISM survey

-

As US job market cools, Fed’s own job gets easier

- Fed’s Bostic, cheered by jobs data, still leans against further rate hikes

- Fed’s Kashkari: a lot of uncertainty about what is driving yield curve

- Hamburg skyscraper construction halted in grim sign for German property sector

- German exports fall more than expected in September

- Traders see fading chances of Fed rate hike, bet on earlier rate cut

The CME Group’s FedWatch Tool’s projections have changed in the past week. It now anticipates the Fed will only hold the Federal Funds Rate steady in a target range of 5.25-5.50% through April (2024-Q2). Starting from 1 May (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.The Atlanta Fed’s GDPNow tool’s estimate of real GDP growth for the current quarter of 2023-Q4 is +1.2%, dropping from the +2.3% annualized growth it projected last week.More By This Author:Dividends By The Numbers In October 2023 Median Household Income In September 2023 U.S. Recession Probability Continues Receding On All Hallow’s Eve

Leave A Comment