I was not too surprised that the hurricane was weaker than expected since we’ve all seen that many times before. But I definitely was not expecting a rally of this strength.

The short-term uptrend has re-asserted itself.

The SPX is pushing into new highs, so it seems time to switch the medium-term trend from down to up. This is a really good looking chart, although it does require an end-of-week confirmation.

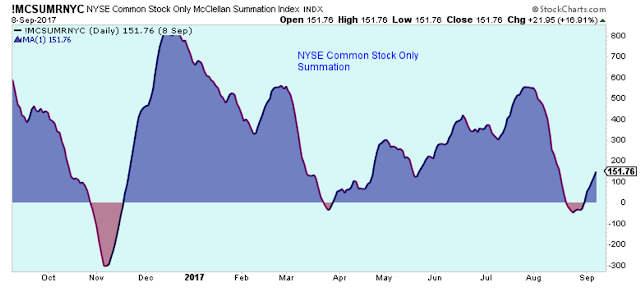

This summation index is confirming the uptrend.

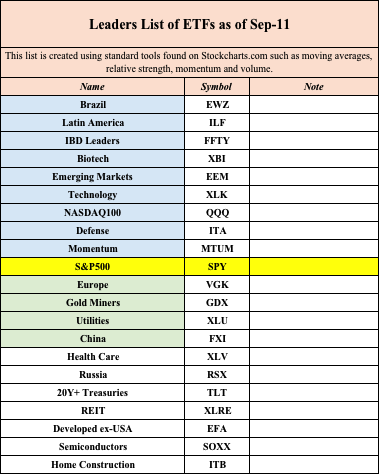

The Leader List

I have changed this spreadsheet. The long-term leaders are blue, the short-term leaders are green and the ETFs showing recent strength are shown at the bottom. The S&P500 is the benchmark.

On rare occasions I have tried to buy the down-and-out ETFs like Energy and Retail, but it just doesn’t work for me. Most of my losses come from buying the ETFs that are underperforming, and almost all of my gains come from buying the leaders.

If you disagree or have an opinion on this strategy, please leave a comment. Thanks!

Momentum stocks continue to perform very well. There is no hint of weakness in this chart.

Emerging Markets hitting new highs again.

The S&P 500 is breaking out to new highs.

Outlook

The long-term outlook is worrisome.

The medium-term trend is up.

The short-term trend is up.

Leave A Comment