Shares of Diebold (NYSE: DBD) are down 24% in just the past two months, pushing its dividend yield to an attractive 4.2%. But can investors rely on that dividend in the future?

Diebold makes ATMs, automation software, security products such as vaults, and a host of other products.

The company has an excellent track record when it comes to paying dividends. It began paying shareholders in 1999 and has raised the dividend every year since.

For the past four quarters, free cash flow was $106.7 million. It paid out $75.4 million in dividends, a payout ratio of 70.7%. I like to see a payout ratio of 75% or below, so Diebold is in my comfort zone.

That 75% level gives me some security that if the company’s cash flow slips, it can still cover the dividend.

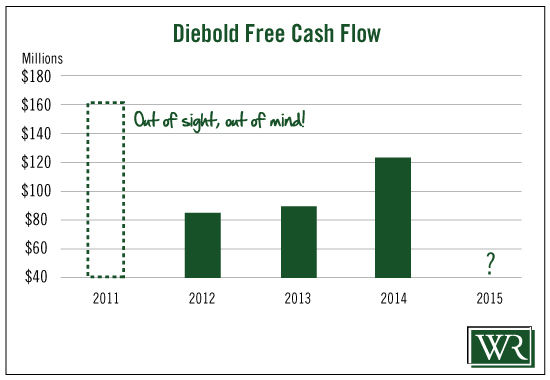

And that’s important because Diebold’s free cash flow has come down in recent years.

In 2011, free cash flow totaled $160 million. It slipped to $86 million the following year as expenses increased. In 2013, free cash flow was mostly stagnant at $89 million as the company’s costs remained high. In 2014, costs were under control and free cash flow totaled $126 million.

Diebold hasn’t announced when it will report annual results, but it likely will report on them in two weeks. At that time, if free cash flow is above 2014’s total, the stock will receive an upgrade to an “A” (assuming no dramatic changes otherwise).

Here’s why: Three-year cash flow growth is one of the variables used in the Safety Net to rate a dividend’s safety. The starting point for this metric is now 2012.

In other words, the steep decline in cash flow Diebold experienced from 2011 to 2012 will no longer factor into its Safety Net rating. Therefore, growth will be much more achievable.

One other area of concern is that cash flow is projected to decline again this year. Given the cushion that Diebold has and its stellar track record, I’m not concerned. But it’s something to keep an eye on. We definitely want to see the company generating more cash flow in the future so we can rest assured that the dividend can be paid.

Leave A Comment