In “It’s ‘Grotesque’! Of Buybacks And Leverage“, we highlighted a recent Bloomberg interview with SocGen’s Andrew Lapthorne who is just as concerned as ever about corporate leverage and is just as unconvinced as he was last year about the relative merits of employing financial engineering in the service of myopic, executive compensation-motivated buybacks.

While it’s always nice to see Andrew get interviewed, that Bloomberg piece kind of veers off into a discussion of the buyback angle at the expense of the leverage debate, which is certainly fine as the two issues are inextricably bound up with one another and also understandable because after all, who doesn’t want to talk about buybacks, right?

But the leverage point is important in and of itself for what it says about the extent to which the post-crisis monetary policy regime has discouraged balance sheet discipline by artificially suppressing borrowing costs as investors scramble down the quality ladder in search of yield.

It takes two to tango (i.e, if investors are willing to accept virtually nothing in the way of a spread above risk-free govies to loan money to corporates, then it’s unrealistic to think management won’t take advantage) but you can’t expect the investment community to “show discipline” in an environment where yield is an endangered species.

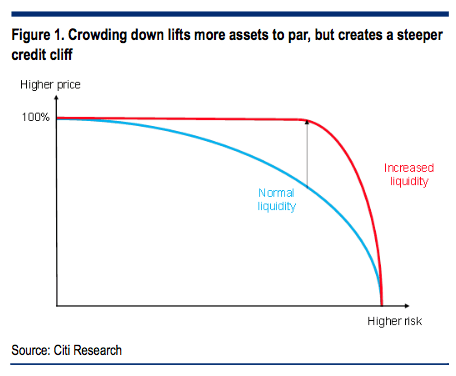

The relentless chase down the quality ladder catalyzed by central banks dumping $15 trillion-ish at the top of that same ladder ensures that everything gets priced to perfection on the way down, with the sole exception of companies that are on the verge of default. Recall this schematic from Citi:

This raises questions about what happens when the accommodation that creates that dynamic fades.

Although the Bloomberg piece doesn’t delve too deeply into that, Lapthorne’s colleague (and most famous bear on the planet outside of Yogi) Albert Edwards takes up the discussion in his latest note, mentioning Andrew’s interview before citing Michael Lewitt re: the the already infamous WeWork offering (funny take on that from my homie Thornton here).

Leave A Comment