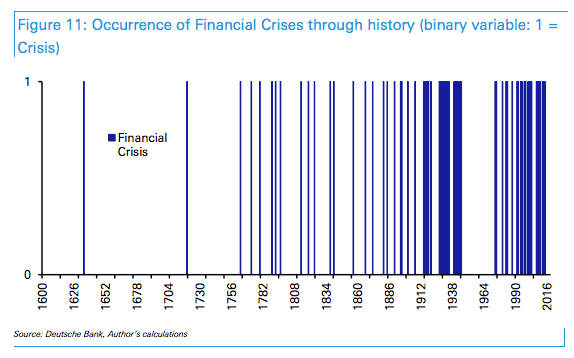

Regular readers will recall that we’ve written a ton on the rolling boom-bust cycles that invariably accompany an untethered system (i.e. a system that is not based on or anchored to a universally accepted, finite store of value like precious metals).

Importantly, we separate this discussion from considerations about the actual value of gold or about the utility of holding it as a hedge against the apocalypse. On the latter point, it’s useless because you can’t eat it or burn it and on the former point, it has no actual value. As UBS bluntly reminds you, “currencies in themselves have no natural value – gold, for instance, is naturally as worthless as paper, sea shells, or wooden sticks.” But again, this is another discussion for another time.

Whatever you want to say about the inherent silliness in deciding that paper money has value because it is “backed” by a yellow metal which is itself naturally worthless, the simple fact of the matter is that at least gold is finite and whether a person who believes it to be valuable is a silly person is actually a silly question, because if enough people believe it has value, then the fact that it actually does not is to a large extent immaterial, and indeed, gold has survived the test of time as a store of value.

Ok, so what is the utility in an unanchored system – again, a system that is not tethered to a finite, universally accepted store of value? Well, the utility lies in an untethered system’s flexibility and the crisis-fighting tools that flexibility affords us. While an unanchored system allows us to combat downturns with unchecked credit creation/money printing, that policy response invariably sows the seeds for the next crisis which will almost always be larger than the last.

“Although the post Bretton Woods financial order has been more crisis and shock prone than the prior 25+ years, and also that seen through most of observable financial history, the reality is that the current period of fiat currencies also arguably allows a buffer against an even greater number of them,” Deutsche Bank’s Jim Reid wrote back in September, characterizing the current system as “a real double edged sword.”

Here is how we described this trade-off and the eventual end game back in September:

While we can observe an increased frequency of crises in a world that’s abandoned the gold standard and while we can draw common sense conclusions from that observation, there’s still the old “correlation doesn’t always equal causation” problem to contend with. That is, “yes” it is likely that the lack of discipline which invariably accompanies an unanchored system contributes directly to the incidence of busts. But it is certain that a constrained system lacks the flexibility to respond to busts when they occur. So if even one crisis out of a dozen isn’t attributable to the adoption of an unanchored system (i.e. a system not based on gold), then by tethering our fate to an archaic concept we may be unnecessarily ensuring a complete collapse from which there is no recovery. Hence Deutsche’s “double edged sword” metaphor.

The worry now however, is that in this latest iteration of responding to a crisis with intervention and money creation, we have exhausted our capacity to leverage (figuratively and literally) the flexibility afforded by an unanchored system to rescue us from the abyss. There’s a cruel irony inherent in that. Each time we respond to a panic with the tools afforded us by a system based not on some finite store of value, but rather based solely on the “full faith and credit” of governments and their printing presses, we almost always exacerbate (in one way or another) the imbalances that led to the very crisis to which we’re responding. The inevitable result: a rolling boom-bust cycle that snowballs with each turn, ensuring that each new crisis and each crisis response is even more spectacular than the last.

The only way this can go on in perpetuity is if we assume there is no limit on the extent to which we can leverage (again, both figuratively and literally) the flexibility inherent in an unanchored (i.e. a fiat-based) system. If the busts keep getting bigger, it will of course be painful and harrowing, but if the capacity of the fiat system to respond with ever larger money printing programs is limitless, then theoretically we will just boom-bust our way along forever until finally we’re all losing everything once every six months only to have central bankers make us all millionaires the very next day by topping up our bank accounts with newly-created money.

Leave A Comment