Another mistake made by several investors is they think they can be smarter than the market. Beating the market… this is something we often read about. While you can perform better than an index or any kind of benchmark, you will not do it each year and you will not do it if you are chasing your return. The market is the market, period.

Understanding how the stock market works… really?

One big delusion many people have is they think they can figure a way to understand where the market is heading. Many stock market gurus are selling their “secret methodology” to predict the future. Do you know how we call people reading the future? We call them charlatans.

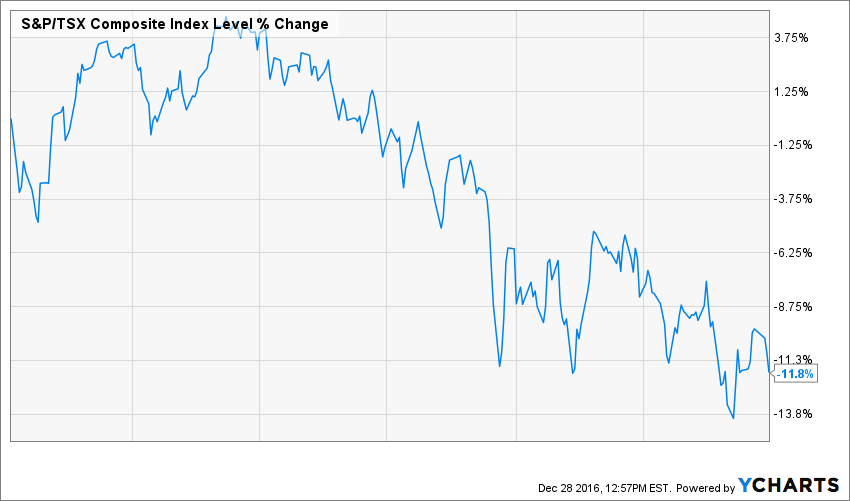

To prove my point, let’s play a little game. I will publish a stock market graph and you will try to guess which way the market will go. I’m taking 12 months periods and you have to decide if the next 12 months will be positive or negative. Here we go with the first example (I’ve removed the date so you can’t cheat!).

source: ycharts

So… is it going up or down? Pretty hectic for a 12 months period, huh? Here’s what happened after January 1st 2015 – January 1st 2016 period:

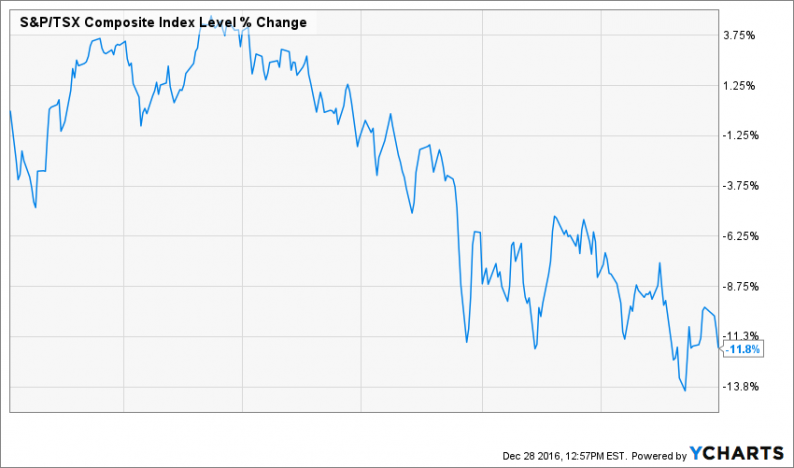

source: ycharts

What is interesting is that during 2015, the Canadian stock market hit the -11% bar three times. Therefore, at 3 different times during 2015, there was a buying opportunity. However, there was also two even lower points in early 2016 with additional losses of 7%. Within the span of 14 months, there were 5 interesting entry point, which one can you really take without any worries?

The stock market isn’t following the economy either

Instead of using technical analysis with “proven algorithm”, some other investors will study macro or micro economic metrics. This is another time-consuming task that will not bring you anywhere. I’m not saying that considering economic data is a waste of time, it is crucial for your portfolio management. Understanding where the economy is heading toward will help you understand why your portfolio is going one way or another and you might find investing opportunities as you build your portfolio.

Leave A Comment