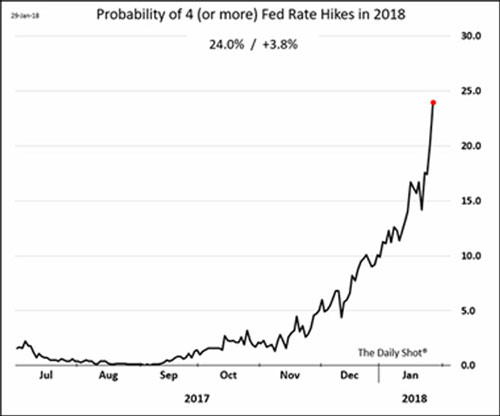

I was finger-scrolling through The Daily Shot the other day (a daily chart package mailed out by The Wall Street Journal—it’s a must-read for everyone in the business), and I came across this:

Source: The Daily Shot

People are getting bulled up on the idea that the Fed might hike more than three times this year.

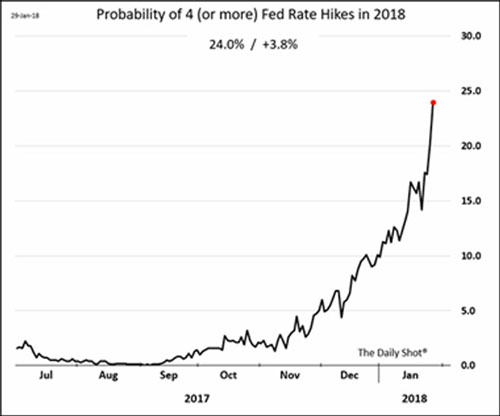

That’s not unreasonable, given that stocks have gone straight up and financial conditions are the easiest they’ve been… ever. I hereby present a chart of the GS Financial Conditions Index.

Source: Bloomberg

Note: an increase in the FCI is evidence of a tightening of financial conditions, and a decrease indicates easing.

Lots of folks (like me) have been telling the Fed to take away the punchbowl. We have bubbles everywhere and we still have negative real interest rates.

Who knows, maybe they will finally listen!

But people have a high degree of certainty about the future path of interest rates at a time when they should have the highest degree of uncertainty about the future path of interest rates. Why? Because we have a new Fed Chairman, of course.

It is possible that we will have more than three rate hikes this year. It is also possible that we will have less than three rate hikes this year.

It is possible that we have zero.

It is possible that we have rate cuts.

Markets being what they are, I will tell you one thing for sure: I don’t know how many rate hikes we have this year, but it probably won’t be three.

Interest Rate Probabilities

Right now, the market is implying an 84.3% chance that we will have two, three, or four rate hikes in 2018, according to Bloomberg calculations based on Fed Funds futures. That is a high degree of certainty.

People are making a lot of assumptions about the Fed:

Leave A Comment